India’s Q1FY23 GDP – Analysis

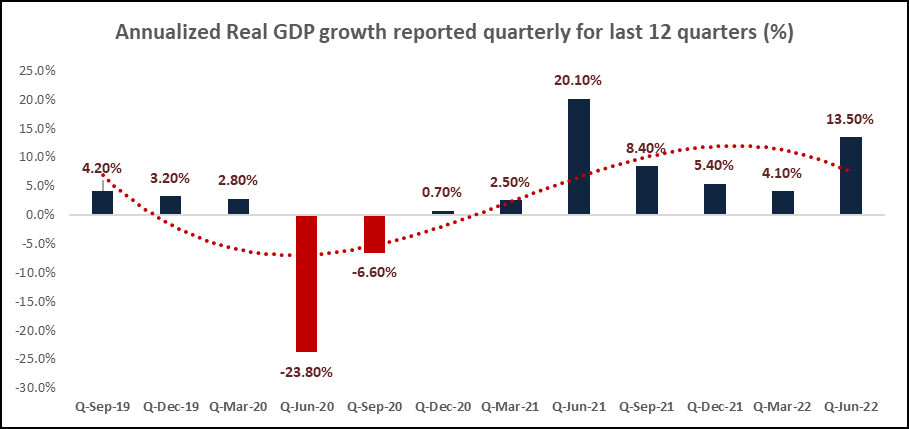

For FY22, India’s real gross domestic product grew at a rate of 8.7%, which is lower than the advance estimates but better than the previous year. Given the current state of global markets, the Reserve Bank of India (RBI) has maintained its projections of a growth rate of 7.2% for FY23. It is important to note that the real GDP growth for FY23 is expected to be the first year since the base effect has been removed. It will also benefit from the falling inflation, which is driven by the central bank’s policy stance. On August 31, the Ministry of Statistics and Programme Implementation (MOSPI) released the first quarter GDP data. The impressive growth rate of 13.5% was expected, but it was disappointing. The street consensus had pegged the real GDP growth at around 15.5% for the first quarter of FY23, while the RBI had pegged it at around 16.2%.

(NOTE: The financial year in India is a period of 12 months that begins on April 1 and ends on March 31 every year. It is a time when income from any source is taxable, and it is also a time when the government makes various assessments and changes in the tax structure. In the whole article the estimated figures have been taken into consideration after the evaluation of first quarter of the current financial year i.e. FY23 or 2022-23, which has also been compared with previous financial year i.e. FY22 or 2021-22.)

According to the Reserve Bank of India, India’s real gross domestic product grew at a rate of 13.5% during the three months ended June 30, 2022. This is lower than the central bank’s estimate of 16.2% for the first quarter of the financial year. The real gross domestic product or GDP at constant (2011-12) prices in the first quarter of 2022-23 is expected to be around 36.85 lakh crore, which is higher than the previous year’s estimate of 32.46 lakh crore. On the other hand, the nominal gross domestic product or GDP at current prices in the same period is expected to be around 64.95 lakh crore, which is higher than the previous year’s estimate of 51.27 lakh crore.

GDP and GVA pan out in Q1FY23

For the first quarter of the financial year, the country’s real gross domestic product (GDP) grew at a rate of 13.5%. This is better than the previous year’s growth rate of 4.2%. It is also expected to grow at a rate of around 36.3% over the next two years. The impressive growth exhibited by the country’s economy during the first quarter of the current financial year is a clear indication that the country’s growth is on the right track.

The country’s real gross domestic product grew at a rate of 13.5% during the three months ended June 30, 2022. This is lower than the central bank’s estimate of 16.2% for the first quarter of the financial year. For the first quarter of the current financial year, the GVA stands at Rs34.42 trillion, which is higher than the previous year’s Rs30.53 trillion. This implies that the country’s economy has grown at a rate of 12.7%.

The growth of the gross value added (GVA) has become a more realistic and comprehensive picture of the country’s macroeconomic situation in the last few years. It is used alongside the GDP to provide a more accurate assessment of the country’s overall economy. In terms of the first quarter of the financial year, GVA is expected to grow at a rate of 15.5%.

Nominal GDP Q1FY23

Before adjusting for inflation, the nominal gross domestic product is a more accurate measure of the country’s overall economic activity. It shows the level of activity and jobs that the country’s economy has generated. During the first quarter of the current financial year, the nominal GDP stood at Rs64.95 trillion, which is higher than the previous year’s Rs30.53 trillion. On a pre-crisis basis, the country’s nominal GDP grew by 67.7%.

Let us first look at the private consumption expenditures, which have shown a positive growth of +39.5% during the first quarter of the current financial year. This is because the private consumption has bounced back and contributed significantly to the country’s overall growth.

In terms of government consumption expenditures, the total amount of money that the country’s government has spent during the first quarter of the current financial year has increased by 10.7%. However, its share of the country’s overall economy has decreased by 160 basis points.

The growth of the gross fixed capital formation has also increased by +31.4% during the first quarter of the current financial year. This is because the private sector has been contributing significantly to the country’s overall growth.

In terms of the VALUABLES sector, the head of the country’s government has moved up from Rs0.32 trillion during the first quarter of the previous financial year to Rs0.50 trillion during the first quarter of the current financial year. This is a positive development, but it shows that the government is still diverting a lot of its spending into idle assets.

The growth of the merchandise exports has increased from Rs11.28 trillion during the first quarter of the previous financial year to Rs14.63 trillion during the first quarter of the current financial year. This is a positive development, as it shows that the country’s economy has started to recover from the crisis.

The value of the country’s merchandise imports has increased significantly during the first quarter of the current financial year. This is because the increase in the import value of various products has contributed to the country’s overall growth.The positive news about the private consumption sector is that it has started to recover from the crisis. However, the increase in the import value of various products has contributed to the country’s overall inflation. This is a concern, as it shows that the government is still not able to control the rising prices.

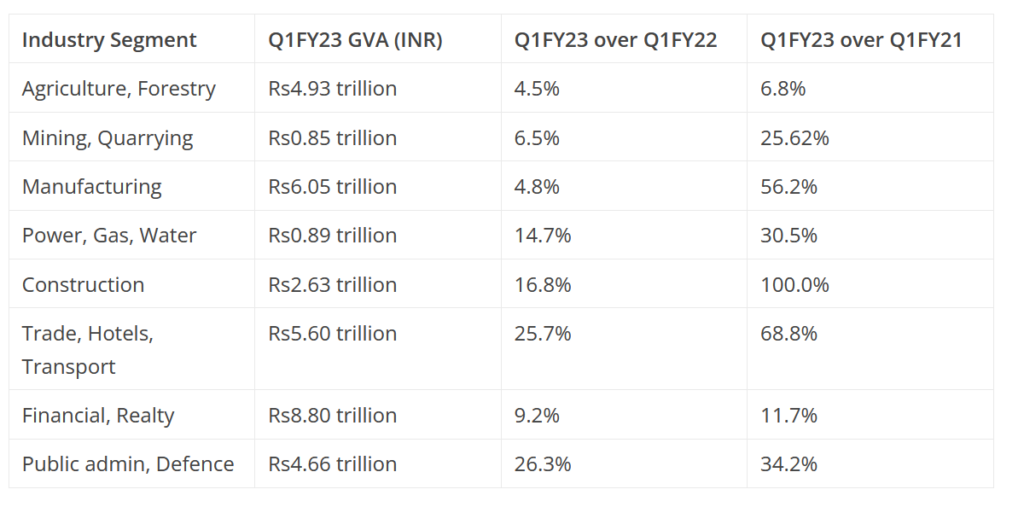

Sectoral Drivers for GVA FY22

The GVA growth of 12.7% during the first quarter of the current financial year can be broken down into various important sectors that can provide a clear indication of the country’s economy’s direction.

The growth of the GVA during the first quarter of the current financial year can be broken down into various important sectors that can provide a clear indication of the country’s economy’s direction. One of these is the trade hotels and transport sectors, which have shown a strong recovery from the COVID lows. These sectors can contribute to the country’s overall GDP growth and provide a boost to the country’s trade industry. On the other hand, manufacturing growth is expected to have strong externalities due to the low level of production.

Despite the various global factors that have affected the country’s economy, such as the war situation in Ukraine and the rising prices, the steady growth of the country’s gross domestic product is still considered a positive development. Going forward, the lower inflation should help boost the country’s real gross domestic product growth.