The Reality Of China’s Monetary Growth And Sluggish Social Financing – Analysis

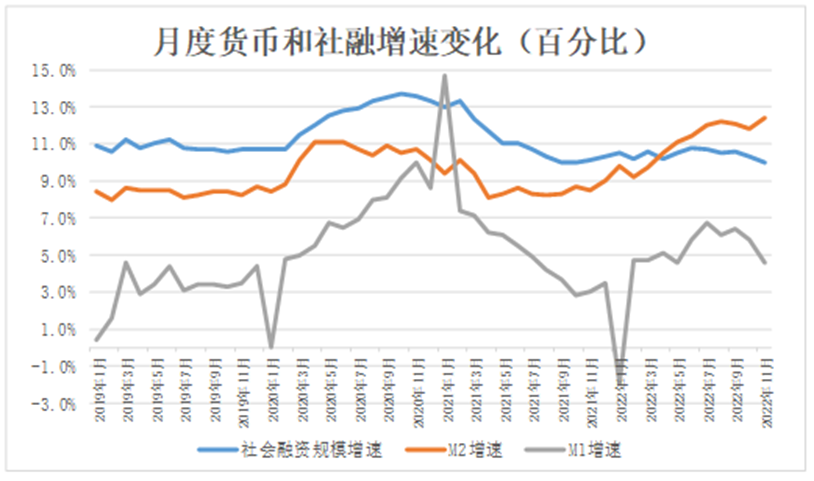

On December 12, data announced by the People’s Bank of China (PBoC) shows that at the end of November, broad money (M2) and narrow money (M1) increased by 12.4% and 4.6% year-on-year respectively, and the growth rates were 0.6 percentage points higher and 1.2 percentage points lower than the end of the previous month; with M2 growth hit a new high since May 2016. With the acceleration of M2’s growth, the growth rate of social financing continued to decline. According to data from the PBoC, the stock of social financing at the end of November was RMB 343.19 trillion, a year-on-year increase of 10%.

This growth rate has fallen from 13.7% in October 2020 to the current level of barely maintaining 10%. While the growth rate of money continues to increase, the growth of social financing is gradually becoming sluggish. Such a contradictory situation shows that under the constraints of the COVID-19 outbreaks, the quandary of China’s economy and finance cannot be easily reversed. This also shows that under the “tight credit” environment, the effect of the country’s monetary easing policy does not show a satisfactory outcome, as the improvement of the market expectations will not happen overnight. According to researchers at ANBOUND, financial data for November indicates that even after the relaxation of the COVID-19 measures, the expected economic recovery will still be a slow process.

Figure: Monthly Monetary and Social Financing Growth Changes (percentage)

Looking at the monetary situation, China faces two issues. The first is the slowdown in the M1 growth rate, in contrast to the continued rise in M2. From the definition of M1 and M2, the growth of demand deposits is lower than that of time deposits, indicating that the current economic activities of the country are relatively sluggish, while the production and operations of businesses and residents have declined. At the same time, with the outbreaks of COVID-19, residents and businesses are more willing to increase savings to deal with uncertainties. These circumstances have led to a substantial increase in time deposits. Data show that in November, Chinese yuan deposits increased by RMB 2.95 trillion, an increase of RMB 1.81 trillion year-on-year. Among them, household deposits increased by RMB 2.25 trillion, non-financial enterprise deposits increased by RMB 197.6 billion, fiscal deposits decreased by RMB 368.1 billion, and non-bank financial institution deposits increased by RMB 668 billion.

The second issue is that RMB loan growth remains subdued. In November, the loans increased by RMB 1.21 trillion, which was RMB 59.6 billion less than the same period last year, although it was a sharp rise from October’s RMB 615.2 billion. In terms of different sectors, household loans increased by RMB 262.7 billion, of which short-term loans increased by RMB 52.5 billion, medium and long-term loans increased by RMB 210.3 billion, a drop of RMB 0.10 trillion and RMB 0.37 trillion year-on-year respectively. Loans to enterprises and institutions increased by RMB 883.7 billion. This figure includes short-term loans which decreased by RMB 24.1 billion, medium and long-term loans increased by RMB 736.7 billion, and bill financing increased by RMB 154.9 billion; while loans from non-banking financial institutions decreased by RMB 9.9 billion. The increase in medium and long-term loans is mainly driven by policies to stabilize investment and the property market. Enterprise and residential real estate investments have improved compared with October. However, in the short term, due to factors such as the COVID-19 outbreaks, the recovery of business activities remains limited. On the other hand, there is still relatively inactive residents’ consumption, and no effective reversal of this is expected to take place within a shorter period.

Since the beginning of this year, the overall balance sheet of residents has shrunk significantly, indicating that the impact of the pandemic and other factors has made their expectations generally weak and hard to reverse. Some analysts believe that since the beginning of this year, the shrinking of residents’ balance sheets has been particularly apparent. In the first 11 months of 2022, although resident deposits increased by RMB 14.95, loans only increased by RMB 3.65 trillion. The difference between the two was as high as RMB 11.30 trillion, far exceeding the average difference between RMB -3 to 3 trillion over the years. It shows that the relatively large increase in resident deposits has not been converted into credit. This signifies that the overall demand for resident loans is weak.

The changes in the scale of social financing also reflect the increasingly prominent contradiction between the current loose money and tight credit. In November, the increase in social financing scale was RMB 1.99 trillion, but it was a significant increase from October’s RMB 907.9 billion though still RMB 610.9 billion less than the same period last year. This shows that China’s credit situation is obviously not as good as in the same period last year when its currency was under highspeed growth. In November this year, RMB loans to the real economy increased by RMB 1.14 trillion, a year-on-year decrease of RMB 157.3 billion. Foreign currency loans to the real economy decreased by the equivalent of RMB 64.8 billion, a year-on-year drop of RMB 51.4 billion. Entrust loans decreased by RMB 8.8 billion, an increase of RMB 12.3 billion year-on-year. Trust loans decreased by RMB 36.5 billion, a year-on-year decrease of RMB 182.5 billion. Undiscounted bank acceptances increased by RMB 19 billion, a year-on-year increase of RMB 57.3 billion. Corporate bond net financing was RMB 59.6 billion, a year-on-year decrease of RMB 341 billion. The net financing of government bonds was RMB 652 billion, a year-on-year decrease of RMB 163.8 billion. The country’s domestic stock financing of non-financial enterprises was RMB 78.8 billion, a year-on-year decrease of RMB 50.6 billion. From January to November, the cumulative increase in social financing scale was RMB 30.49 trillion, RMB 1.51 trillion more than the same period of the previous year. It is worth noting that corporate bond financing has fallen sharply. The issuers of corporate bonds in the bond market are generally leading companies in the industry. Although the slump in financing is due to the fluctuations in the bond market in November, the sluggish financing needs and motivation of the companies themselves contribute more to the current situation. This actually reflects the dilemma faced by most businesses, that is, they have no ability nor interest in financing development under the circumstances of external turmoil, and only seek to survive. Such an outcome determines that social financing still mainly relies on the financing of policy investment for support.

The lag in financial data signifies that the November data does not fully reflect the improvement of market expectations after China’s relaxation of the COVID-19 policies. This includes the effect of RRR cuts and a series of financial support policies, which are more likely to be reflected in the data in December and next year. Even so, researchers at ANBOUND still emphasized that the improvement of market expectations may not be fast. On the one hand, there must be obvious signs of improvement at the economic and financial market levels. On the other hand, the relaxation will result in more novel coronavirus outbreaks which will affect economic activities, making it difficult to effectively reverse market expectations in the short term. From this point of view, it is still a gradual process for China to see loose money to loose credit. The recovery of market expectations and the economy too, will be a difficult and long process.

Final analysis conclusion:

Data in November show that the scissors gap between China’s monetary growth and its social financing growth is still widening, and the contradiction between “loose money” and “tight credit” remains prominent. This reflects that there are persisting challenges in improving market expectations even when the country’s COVID-19 policies are relaxed. The improvement of such expectations, like the economic recovery, will be a long, gradual process.