China’s Economy Requires Reasonable Recuperation While Recovering – Analysis

The work reports of the governments of China’s 31 provinces, autonomous regions, and municipalities have recently been released, disclosing their economic growth data for 2022 and their targets for 2023. From the data of each province, the performance of China’s overall macro economy and the trend of future development can be discerned.

According to the researchers at ANBOUND, this reflects that the general macroeconomic situation of the country is not exactly optimistic. On the one hand, the economic growth of various regions in 2022 is generally lower than the previous target. On the other hand, local economic expectations for 2023 are also lower than the targets set for 2022. This means that the country will still face greater pressure to achieve stable growth in 2023.

Looking at the situation in 2022, the current general view is that the continuous impact of the COVID-19 pandemic, coupled with changes in domestic and foreign situations and other factors, caused China’s economic growth last year to be lower than the 5.5% target set at the beginning of 2022. According to the data released by 31 provinces so far, 24 provinces that have announced the actual growth rate of GDP in 2022 have all achieved positive growth. Except for Beijing and Hainan, which only pointed out the trend of “positive growth”, the remaining 22 provinces and cities have announced specific values, ranging from 2% to 5%, all are lower than the expected target set earlier.

At the same time, the six provinces with an actual growth rate of more than 4.5% are all in the central and western regions, and the developed coastal areas in the southeast generally have a lower growth rate. As far as the top four economic provinces are concerned, Guangdong’s annual GDP is expected to grow by about 2% to reach RMB 12.8 trillion, ranking first in the country for 34 consecutive years. Jiangsu’s GDP in 2022 is expected to exceed RMB 12 trillion, while Shandong’s expected growth is about 4% in 2022, reaching about RMB 8.7 trillion, while for Zhejiang it is 3%. Among the four municipalities directly under the central government, due to the impact of the pandemic, Shanghai’s GDP is expected to reach RMB 4.45 trillion in 2022, a year-on-year increase of 3%, and this growth rate still ranks first among the municipalities directly under the central government.

Beijing stated that it could achieve positive growth, but did not announce the growth rate. Tianjin’s GDP in 2022 was RMB 1.6 trillion, an increase of about 1.9%, and Chongqing’s was about 2%. These provinces and cities with a strong aggregate base and as the drivers of the economy generally have a low growth rate, which directly reflects that China’s economic situation in 2022 is rather severe.

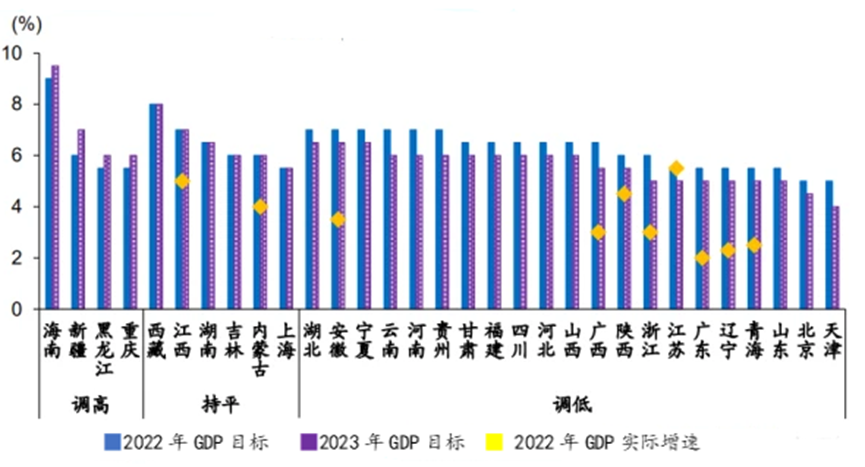

In terms of the goals for 2023, most provinces and cities have lowered their GDP targets compared with the previous year, indicating that all localities are quite cautious in their expectations for the future. According to media statistics, more than half of the provinces have set their growth targets for 2023 above 5.5%. Among them, Hainan set a GDP target of 9.5%, ranking first; Tibet ranked second with 8%, and Jiangxi and Xinjiang tied for third with 7%. 21 provinces including Henan, Tianjin, Zhejiang, Beijing, Jiangsu, and Guangdong lowered their expected growth rate by 0.5 to 1 percentage point. 6 provinces including Jilin, Hunan, and Jiangxi maintained their growth rate without changes. Xinjiang Uygur Autonomous Region, Chongqing, and other provinces raised their expected growth rate by 0.5 to 1 percentage point. According to the research of Sinolink Securities, the average local GDP growth target in 2023 is set to be 5.9%, which is 0.4 percentage points lower than the average target of 6.3% in 2022.

Considering that the targets of various regions are generally higher than those of the whole country, it can be inferred that the actual growth target of national GDP in 2023 should be maintained at around 5%, which is expected to be lower than the expected growth target of 5.5% in 2022. Some international institutions such as the IMF still have expectations for China below 5%, and they are not optimistic about China’s economic recovery.

Figure: China’s 2022/2023 Economic Growth Targets by Regions

As for how the economy will recover in 2023, locality-wise, the focus will be on investment and consumption. According to the report of Sinolink Securities, the growth rate target of local fixed asset investment in 2023 is 8.4% on average, with industrial transformation and upgrading, and advanced infrastructure layout being local key tasks. The local expansion of effective investment is mainly to promote industrial transformation and upgrading, as well as the enhancement of infrastructure. This is in line with the requirements of China’s 20th National Congress and the Central Financial Work Conference to promote the development of the real economy.

Considering the growth rate of national fixed asset investment was 4.9% in 2021; and 5.3% in the first 11 months of 2022, in the new year, the impetus to promote economic growth through investment will be stronger. With this, the objective of “promoting investment” to achieve “steady growth” too, will be clearer as well. However, taking into account the increasing pressure on fiscal revenue and expenditure and the increasing local debt burden faced by all localities in 2022, only relying on proactive fiscal policies to promote government investment in 2023 may appear to be out of reach. It is more necessary for the whole society to release market space and promote the recovery of private investment.

According to the report of Sinolink Securities, as of January 15, 20 provinces and cities have set a growth rate target for the total retail sales of consumer goods, with an average of 7.9%. The retail sales targets of 9 provinces and cities including Tianjin were lowered, and for the 3 provinces and cities including Hubei, it remains the same. In the government work report, many places have given priority to expanding domestic demand and promoting consumption.

That being said, judging from the differentiation of local goals, it is still challenging to recover consumption. In addition to issuing consumer coupons to encourage short-term consumption, the main focus will be on long-term factors such as the consumption environment, improving the quality of supply, and increasing residents’ income. Hence, it may be difficult to achieve direct results in the short term. On the whole, the local government regards investment and consumption as the main task, which also shows that when the growth of external demand is generally bleak, the local government has focused its main energy on stabilizing and expanding internal demand.

The actual economic growth performance of various regions in China in 2022 and the adjustment of the 2023 target directly reflect the severe damage to the Chinese economy caused by the COVID-19 outbreaks in the past three years. Moreover, in the context of generally difficult local economies and finances, it may be hard for the country to push for the new year’s goals. Regarding the trend of economic growth in 2023 and China can set its economic growth targets, researchers at ANBOUND believe that in the post-pandemic period, economic recovery is a process of recuperation. Moreover, China’s economy has already been damaged, and recovery is a mid-to-long-term process. Therefore, it should not rush for quick success and set too high goals to meet the five-year plan. In 2023, the overall goal should be a limited recovery.

Concerning recuperation, the focus should be on the market economy and marketization, as well as the development of private enterprises. All in all, a country’s economy is related to people’s livelihood and ultimately is linked to private enterprises in resolving the problem. In particular, the proactive fiscal policy in the past years was mainly developed through borrowing. After several years of challenges and the economic growth rate continues to decline, the current policy resources are rather limited. The direction of resource allocation and use has become crucial, as a result. Therefore, such limited resources should not be used up in some major national-level projects. The direction of resource use in the future, according to the researchers at ANBOUND, is to pay attention to people’s livelihood and ensure basic stability. Importance should also be given to guiding and promoting market-oriented reforms, giving full play to the role of market mechanisms, and gradually strengthening market players, thereby laying the foundation for long-term sustainable economic growth in the future.

Final analysis conclusion:

The actual economic growth performance of various regions of China in 2022 and the adjustment of the 2023 target directly reflect the severe damage to the Chinese economy caused by the pandemic in the past three years. This has caused local governments, which were previously bold and optimistic, to become cautious about future development. An implication of this is China’s economic recovery will be a long-term process, and what is more needed now is a reasonable recuperation, without setting unrealistic goals for short-term growth.