China’s Changing Global Economic Relations As Reflected In Foreign Trade Data – Analysis

On May 9, China’s General Administration of Customs released the latest data on the country’s foreign trade, revealing changes in the situation facing the Chinese economy and its relationship with global economies.

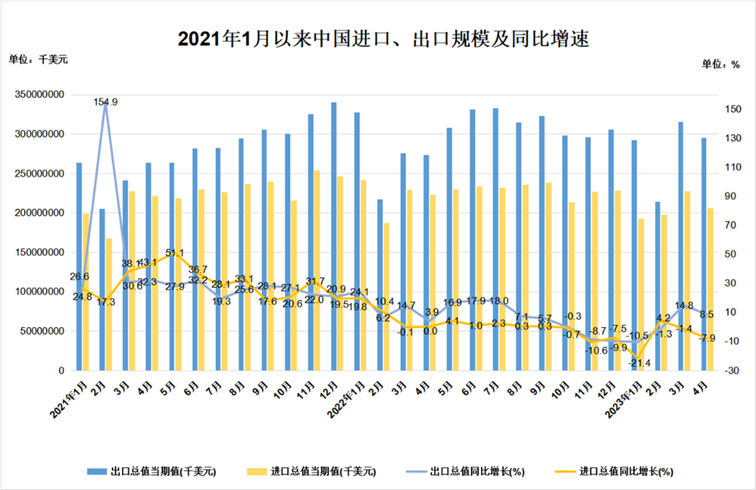

In the first four months of this year, the total value of China’s foreign trade imports and exports was RMB 13.32 trillion (approx. USD 2.07 trillion), a year-on-year increase of 5.8%. Of this, its exports were RMB 7.67 trillion (approx. USD 1.19 trillion), a year-on-year increase of 10.6%, and imports were RMB 5.65 trillion (approx. USD 879.7 billion), a year-on-year increase of 0.02%. In April of this year, the country’s imports and exports were RMB 3.43 trillion (approx. USD 533.3 billion), an increase of 8.9%.

Among them, exports were RMB 2.02 trillion (approx. USD 313.7 billion), an increase of 16.8%, and imports were RMB 1.41 trillion (approx. USD 219.5 billion), a decrease of 0.8%. The trade surplus was RMB 618.44 billion (approx. USD 96.1 billion), an increase of 96.5%. Calculated in the USD, China’s imports and exports in April were USD 500.63 billion, an increase of 1.1%. Among them, exports were USD 295.42 billion an increase of 8.5%, and imports were USD 205.21 billion, a decrease of 7.9%. The trade surplus was USD 90.21 billion, an increase of 82.3%.

In terms of major trading partners, ASEAN remains China’s largest trading partner in the first four months of this year, with a total trade value being RMB 2.09 trillion, a year-on-year increase of 13.9%, accounting for 15.7% of China’s total foreign trade value. The European Union is China’s second-largest trading partner, with a total trade value of RMB 1.8 trillion, an increase of 4.2%, accounting for 13.5%. The United States is the country’s third-largest trading partner, with a total trade value of RMB 1.5 trillion, a decrease of 4.2%, accounting for 11.2%. This is followed by Japan, with a total trade value of RMB 731.66 billion, a decrease of 2.6%, accounting for 5.5%. In the first four months, China’s imports and exports to the Belt and Road countries totaled RMB 4.61 trillion, an increase of 16% year-on-year. Among them, imports and exports to Central Asian countries such as Kazakhstan, as well as to countries in West Asia and North Africa such as Saudi Arabia increased by 37.4% and 9.6%, respectively.

Looking at the first four months, China’s foreign trade import and export increased by 5.8% year-on-year, which is 1 percentage point higher than the 4.8% year-on-year growth in the first quarter of this year. However, the data for April actually began to slow down. In March of this year, China’s goods exports increased by 23.4% year-on-year in RMB and 14.8% in USD; imports increased by 6.1% year-on-year in RMB and decreased by 1.4% in USD. All data for April actually slowed down, decreasing by 6.6 percentage points in RMB to a year-on-year growth of 16.8%, and slowing down by 6.3 percentage points in USD to a year-on-year growth of 8.5%. In April, the import growth rate slowed down by 6.9 percentage points in RMB, to a decrease of 0.8%, and slowed down by 6.5 percentage points in USD, decreasing 7.9%. Therefore, it is worth paying attention to whether China’s foreign trade growth rate will continue to slow down subsequently.

Notably, China’s trade with major trading partners has undergone subtle changes. Among them, its trade relationship with ASEAN has become increasingly asymmetrical, with China’s exports to ASEAN increasing by 24.1% year-on-year in the first three months of this year, while imports from ASEAN only increased by 1.1% year-on-year, resulting in a trade surplus that expanded by 111.4%. This sharp increase in China’s exports to and trade surplus with ASEAN is related to the transfer of many Chinese manufacturing companies to ASEAN countries, which has driven China’s exports of raw materials and parts to ASEAN. Meanwhile, China’s trade volume with the United States and Japan has been decreasing. In the first four months of this year, China’s exports to the U.S. decreased by 7.5% year-on-year, while imports from it increased by 5.8% year-on-year, resulting in a trade surplus that narrowed by 14.1%. The decline in the China-U.S. trade relationship is a sign that the paces of “decoupling” are increasing. The trade volume between China and Japan, the fourth largest trading partner, has also decreased, this too indicates trade “decoupling”. However, China’s trade relationship with the European Union remains stable with slight growth. The EU is China’s second-largest trading partner, and maintaining stable trade with the EU is of great significance in the context of reduced trade between the U.S., Japan, and China.

Finally, the main driver of China’s foreign trade is private enterprises, which should be supported by national policies. According to customs statistics, there were 415,000 private enterprises with import and export records in the first four months of this year, an increase of 8.9% year-on-year. Private enterprises continue to maintain their position as China’s largest operating entity in foreign trade. In the first four months, the import and export value of private enterprises was RMB 7.05 trillion, a year-on-year increase of 15.8%, accounting for 52.9% of China’s total foreign trade value. It should also be pointed out that the active participation of Chinese private enterprises in foreign trade also helps China maintain more initiative and control in global supply chain adjustments, partially reducing the impact of the withdrawal of the supply chain from China. For example, under the RCEP framework reached between China and ASEAN, the rules of origin agreement and labor cost factors have attracted Chinese companies to shift their investments to ASEAN, where products are processed and then exported. However, the upstream and middle-stream resources industry chain clusters, such as components and raw materials, mainly remain in mainland China.

Over the past three years, China’s foreign trade environment and its relationship with the global economy have undergone enormous changes. For instance, in 2022, China experienced significant changes due to the pandemic, escalating geopolitical frictions, and the impact of the Russia-Ukraine war on the global stage. The booming scene of China’s foreign trade, which had experienced a high-speed growth of 20-30% in 2021, is unlikely to return. Looking at the trends, China’s role as the “world’s factory” will be further weakened in the future. After the adjustment of the global supply chain and the decrease in its trade importance, China needs to rebuild its relationship with the economy worldwide, and its relevant policy system needs to be adjusted accordingly.