Recovery Of China’s Economy: Between Surface And Reality – Analysis

China’s National Bureau of Statistics (NBS) announced on May 16 the major economic data for April. There have been many doubts from various sectors of society and the market regarding the recovery of the country’s economy in the first quarter, as there is a significant discrepancy between macro data and the actual perception and micro-level performance. The macroeconomic data helps to provide a better understanding of the current status of China’s economic recovery.

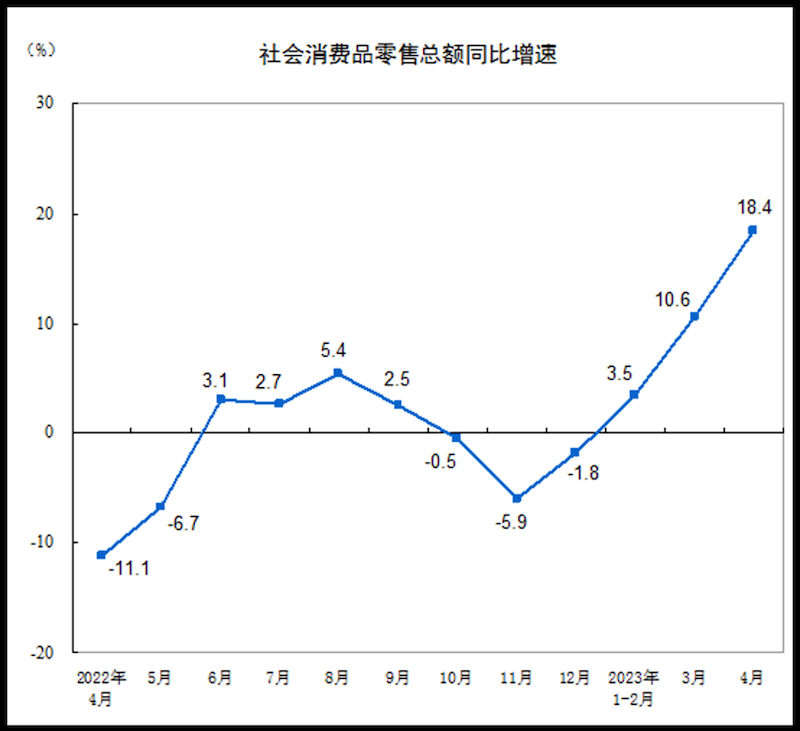

In April of this year, the total retail sales of consumer goods reached RMB 3.491 trillion, an increase of 18.4% year-on-year (YoY). Among them, the retail sales of consumer goods excluding automobiles amounted to RMB 3.129 trillion, an increase of 16.5%. From January to April, the total retail sales of consumer goods reached RMB 14.9833 trillion, a YoY increase of 8.5%. Among them, the retail sales of consumer goods excluding automobiles amounted to RMB 13.5719 trillion, an increase of 9.0%.

Due to last April’s consumption growth being at the lowest point of the year (-11.1%), and considering the low base effect, as well as the post-pandemic recovery this year, there was a relatively rapid YoY rebound in consumption in April. However, compared to the total retail sales of consumer goods in March this year, which amounted to RMB 3.7855 trillion, the scale of consumption in April actually decreased by RMB 294.5 billion. Among them, the retail sales of consumer goods excluding automobiles decreased by RMB 230.1 billion. Therefore, the high YoY growth in consumption in April is not the most important factor. It is also crucial to consider the month-on-month (MoM) changes in the scale of consumption, which is an important indicator for observing the recovery of consumption this year.

Figure 1: YoY Growth Rate of China’s Total Retail Sales of Consumer Goods

When it comes to the industrial sector, in April, the added value of industries above the designated size increased by 5.6% YoY, which was 1.7 percentage points more than the previous month. From a MoM perspective, the added value of industries above the designated size decreased by 0.47% in April compared to the previous month. From January to April, the added value of industries above the designated size increased by 3.6% YoY. Looking at the three major categories, the added value of the mining industry remained unchanged YoY while manufacturing increased by 6.5% and the production and supply of electricity, heat, gas, and water increased by 4.8%. The added value of equipment manufacturing increased by 13.2% YoY, which was 5.3 percentage points faster than the previous month. From an economic type perspective, in April, the added value of state-owned enterprises increased by 6.6% year-on-year, while that of joint-stock enterprises increased by 4.4%, and that of foreign-invested enterprises and enterprises from Hong Kong, Macao, and Taiwan increased by 11.8%. The added value of private enterprises increased by 1.6%. It can be seen that the added value of the industrial sector continued to recover in April, but noteworthily that there was a decrease in the added value on a MoM basis.

When it comes to investment, the national fixed asset investment (excluding rural households) reached RMB 14.7482 trillion from January to April this year, showing a year-on-year increase of 4.7%. However, in April, there was a MoM decline of 0.64% in fixed asset investment (excluding rural households). This slowdown is notable when compared to the investment growth rate of 5.1% in the first three months of the year. It indicates that domestic investment has not experienced a significant rebound despite the relaxation of pandemic measures and the implementation of various stimulus policies. Instead, it remains on a trajectory of inertia-driven deceleration. Breaking it down further, the fixed asset investment of state-owned enterprises saw a 9.4% year-on-year increase (compared to 10% in the first three months), while private fixed asset investment amounted to RMB 7.957 trillion, showing a modest YoY increase of 0.4% (compared to 0.6% in the first three months). These figures clearly highlight the current weakness in China’s domestic investment, with the growth rate continuing to decline. Such a situation underscores the lack of sufficient confidence in private investment.

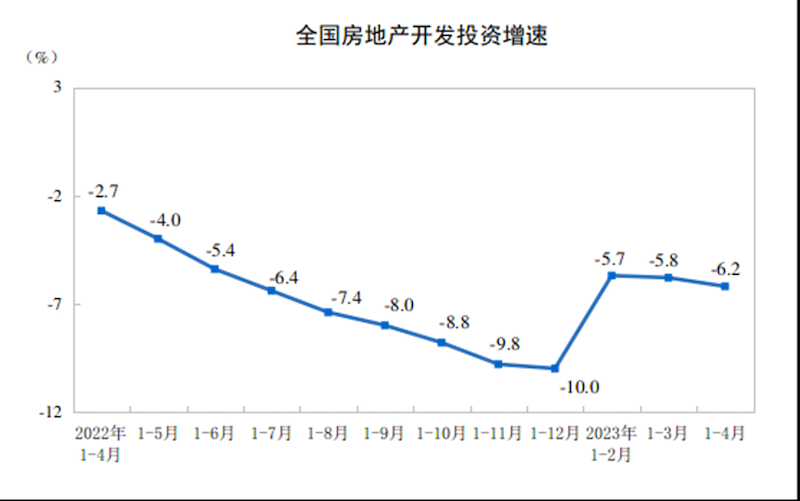

The weak investment is closely tied to the decline in real estate investment. From January to April this year, the national real estate development investment amounted to RMB 3.5514 trillion, indicating a YoY decrease of 6.2% (calculated on a comparable basis). Among them, residential investment reached RMB 2.7072 trillion, experiencing a decline of 4.9%. It is evident that despite the emphasis on policies such as guaranteeing property project delivery and support for financing, yet under the measures to curb housing speculations, real estate investment continues to decline. Researchers at ANBOUND maintain their previous judgment that, under policy tone and market pressure, the downward trend in China’s real estate investment is nearly irreversible. The continuous negative growth of real estate development investment not only hampers its domestic investment growth but also shapes the fundamental environment and future development trends of the real estate market. This industry is expected to keep shrinking, leading to a continuous outflow of funds and a negative impact on local government finances.

Figure 2: National Real Estate Development Investment Growth Rate

Regarding imports and exports, China’s foreign trade volume witnessed a YoY increase of 5.8% in the first four months of this year, surpassing the 4.8% growth in the first quarter. However, upon closer examination of the monthly data, a slowdown in April becomes evident. In March, China experienced significant growth in goods exports, with a 23.4% increase in RMB terms and a 14.8% increase in USD terms. In contrast, imports rose by 6.1% in RMB terms but declined by 1.4% in USD terms. Moving to April, an overall deceleration in growth occurred. Exports in RMB terms declined by 6.6 percentage points, resulting in a YoY growth rate of 16.8%. In USD terms, the growth rate slowed by 6.3 percentage points, reaching 8.5%. As for imports in April, the growth rate in RMB terms dropped by 6.9 percentage points, leading to a decline of 0.8%, while in USD terms, it decelerated by 6.5 percentage points, resulting in a drop of 7.9%. Therefore, it is crucial to closely monitor whether China’s foreign trade growth will continue to decelerate in the upcoming period.

When it comes to employment, in April, the nationwide surveyed urban unemployment rate was 5.2%, representing a decrease of 0.1 percentage points compared to the previous month. The surveyed unemployment rates for the age groups 16-24 and 25-59 were 20.4% and 4.2%, respectively. Among the 25-59 age group, the surveyed unemployment rates for individuals with a primary school education or below, a high school education, a college education, and a bachelor’s degree or above were 4.5%, 4.6%, 4.0%, and 3.1%, respectively. The surveyed urban unemployment rate in 31 major cities was 5.5%. It is evident that the most pressing issue in the employment field is the persistently high unemployment rate among young people. In April, the unemployment rate for the 16-24 age group reached 20.4% and continued to rise. Therefore, it is crucial and urgent for China to stabilize and expand employment opportunities for young people in the next step.

Looking at prices, in April, the national consumer price index (CPI) rose by 0.1% YoY and decreased by 0.1% MoM. From January to April, the national CPI increased by 1.0% YoY. In April, the national producer price index (PPI) for industrial production decreased by 3.6% YoY and decreased by 0.5% MoM. The national producer purchase price index also declined by 3.8% YoY and decreased by 0.7% MoM. From January to April, the national PPI for industrial production and producer purchase price index decreased by 2.1% and 1.5% YoY, respectively. As for the price indices, both at the consumer and producer ends, there is a lack of vitality and insufficient demand. Some institutions and individuals, including ANBOUND, express concerns about a potential economic downturn in China, which is closely related to low prices and sluggish consumption. However, the People’s Bank of China (PBoC) and the NBS have both denied the occurrence of an economic recession in the country.

According to the official view on the current state of China’s economic recovery, the economy and society have fully returned to normal operations. Most production and demand indicators have shown an increase in YoY growth rates. The service industry and consumption have recovered relatively quickly, and overall stability has been maintained in employment and prices. Such a view believes that the country’s economic performance continues to show a positive trend of recovery. However, from our perspective, this represents the surface of China’s economy. Looking at investment, employment, prices, and the performance of microeconomic entities, it is evident that there is still a significant lack of domestic demand. Hence, it is also a reality that the internal driving force for economic recovery remains relatively weak, and challenges such as unemployment and fiscal issues pose significant pressures.

Final analysis conclusion:

In relation to the economic performance of China during the initial four-month period, certain analysts have asserted that the most recent data has provided an opportunity for further reductions in the reserve requirement ratio and interest rates, giving rise to speculations regarding potential adjustments in the upcoming month of June. From our vantage point, taking into account the significant setbacks endured by the Chinese economy over the preceding three years, it is probable that it will remain in a state of recovery throughout the entirety of this year. During this period, the economy needs to recuperate and regain vigor organically, rather than undergoing rapid and mass stimulation. Therefore, it is crucial for the country’s policy authorities to exercise prudence under this circumstance.