Long-Term Nature Of China’s Economic Recovery As Seen From May’s Monetary And Financial Data – Analysis

On June 13, China’s central bank released the somewhat belated monetary and financial data for May. As predicted by researchers at ANBOUND, the data for May showed a slowdown in both monetary indicators and social financing.

This reflects that after achieving better-than-expected economic growth in the first quarter, the phase of demand rebound, which was suppressed by the pandemic, has passed, and the Chinese economy is entering a period of recovery. Overall, due to the base effect, the economic growth rate in the second quarter may be high, but it increasingly shows a tendency of insufficient endogenous driving force.

This can also explain the reason behind the central bank’s decision on June 13 to lower the reverse repo rate, to further reduce policy rates and market credit rates, as the economic growth is lower than expected and the economy is following the path of post-COVID slow recovery. Restoring development momentum and maintaining the sustainability of economic stability and growth are the challenges that the country needs to address in the next stage of macroeconomic policy.

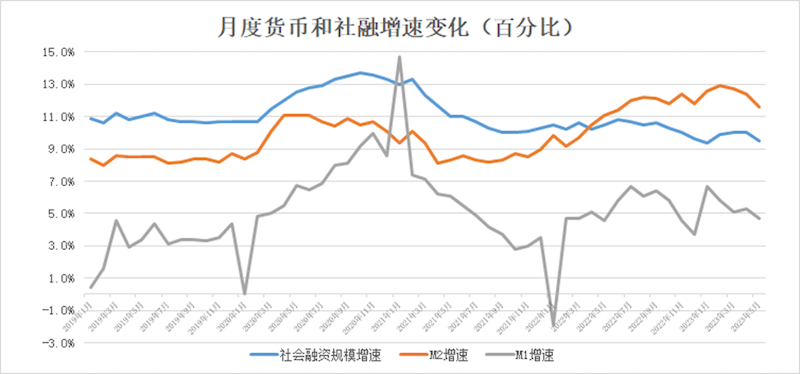

Figure: Monthly changes in the currency and social financing growth rates (percentage).

At the end of May, the broad money supply (M2) reached RMB 282.05 trillion, representing a year-on-year growth of 11.6%, which is 0.8 percentage points lower than the end of the previous month but 0.5 percentage points higher than the same period last year. The narrow money supply (M1) amounted to RMB 67.53 trillion, with a year-on-year growth of 4.7%, which is 0.6 percentage points lower than the end of the previous month but 0.1 percentage points higher than the same period last year. The currency in circulation (M0) stood at RMB 10.48 trillion, with a year-on-year growth of 9.6%. The net cash withdrawal for the month was RMB 114.8 billion. It is worth noting that both the year-on-year growth rates of M1 and M2 declined at the end of May, indicating a decrease in overall economic activity, in addition to the impact of moderately withdrawing monetary policy. Concerns about a “double-dip” in domestic economic performance raised earlier are not unfounded, as the trend of slowing economic growth and weak momentum has become quite evident.

Looking at the growth of RMB loans, in May, with the significant increase in incremental loans (RMB 1.36 trillion) compared to April (RMB 718.8 billion), the balance of RMB loans at the end of May was RMB 227.53 trillion yuan, a year-on-year increase of 11.4%. The growth rate was 0.4 percentage points lower than at the end of the previous month but 0.3 percentage points higher than the same period last year. However, in terms of the year-on-year growth of RMB loans in May, the increase was RMB 541.8 billion less. Despite this, the growth of RMB loans indicates a slowdown in the real economy. Encouragingly, household loans increased by RMB 367.2 billion in May, with short-term loans increasing by RMB 198.8 billion and medium- to long-term loans increasing by RMB 168.4 billion. This significant improvement compared to the decrease in household loans in April indicates more support for consumption and the real estate market’s recovery. In addition, in May, loans to corporate entities increased by RMB 855.8 billion, with short-term loans increasing by RMB 35 billion, medium- to long-term loans increasing by RMB 769.8 billion, and bill financing increasing by RMB 42 billion. Non-bank financial institution loans increased by RMB 60.4 billion. All in all, the situation of corporate loans continued to improve compared to April, especially with short-term loans transitioning from contraction to growth, indicating a gradual recovery in corporate operations. This is the optimistic information reflected in the monetary data for May.

Another piece of good news for the country’s economy is that RMB deposits have changed from a decline in April to an increase. In May, RMB deposits increased by RMB 1.46 trillion, with a year-on-year decrease of RMB 1.58 trillion. Among them, household deposits increased by RMB 536.4 billion n, non-financial corporate deposits decreased by RMB 139.3 billion, fiscal deposits increased by RMB 236.9 billion, and non-bank financial institution deposits increased by RMB 322.1 billion. The growth of household deposits, in particular, indicates that as the economy recovers, household incomes are beginning to grow again, leading to a change in the trend of deleveraging in the household sector. Especially with the downward adjustment of deposit interest rates, this change signifies the restoration of market confidence and increases the potential and space for consumption. However, overall, RMB deposit growth still lags behind the same period last year, which means that the recovery of the economy and income still requires time.

The stock of social financing at the end of May reached RMB 361.42 trillion, with a year-on-year growth of 9.5%. This growth rate has declined from 10% in March and April. This trend, along with the decline in monetary growth, indicates an increasingly apparent slowdown in economic growth. Preliminary statistics show that in May 2023, the incremental scale of social financing was RMB 1.56 trillion, an increase of RMB 331.2 billion compared to the previous month, but a decrease of RMB 1.31 trillion compared to the same period last year. Among them, RMB loans issued to the real economy increased by RMB 1.22 trillion, with a year-on-year decrease of RMB 617.3 billion. Entrusted loans increased by RMB 35 billion, with a year-on-year increase of RMB 16.7 billion. Trust loans increased by RMB 303 billion, with a year-on-year increase of RMB 92.2 billion. Undiscounted bank acceptance bills decreased by RMB 179.7 billion, with a year-on-year decrease of RMB 72.9 billion. Corporate bond financing decreased by RMB 217.5 billion, with a year-on-year decrease of RMB 254.1 billion. Government bond net financing decreased by RMB 557.1 billion, with a year-on-year decrease of RMB 501.1 billion. Non-financial corporate domestic stock financing increased by RMB 75.3 billion, with a year-on-year increase of RMB 46.1 billion. Compared to the same period last year, not only did RMB loans decline, but direct financing such as corporate bonds and government bonds also saw significant declines, indicating a decrease in overall financing demand. This implies that, on one hand, after the credit “boom” at the beginning of the year, corporate financing needs have been temporarily met. On the other hand, the sustainability of financing is insufficient, which is more likely due to the need for market confidence to be restored.

The fluctuations observed during the process of economic and financial recovery highlight that the macro economy is currently undergoing a gradual healing phase, characterized by a slow recovery. It is evident that the economic recovery remains inadequate and lacks balance. Consequently, it is crucial for both market participants and policymakers to recognize the intricacies and long-term nature of this recovery process. By doing so, they can form precise and rational expectations, enabling them to make well-informed decisions and implement appropriate policies.

Final analysis conclusion:

When considering the overall picture, the simultaneous decline in the growth rates of monetary aggregates M2 and M1, along with the scale of social financing, indicates a noticeable slowdown in the macroeconomic environment. This highlights the importance of implementing a monetary policy that reinforces counter-cyclical adjustments. However, amidst the economic recovery process, there are also positive indications of improvement in certain atypical areas like deposits and loans. The conflicting signals emitted by various data sources suggest an ongoing state of imbalanced economic recovery, intensifying divergent expectations regarding economic trends and adding complexity to the implementation of macroeconomic policies.