Shipbuilding: A New Front For US-China Competition – Analysis

While the Trump administration may appear focused on trade, tariffs, and maximising economic gains, recent moves suggest otherwise. Steps taken in the last 100 days indicate that the United States (US)-China competition—particularly in the maritime domain—is now an indispensable part of any Washington agenda.

On 9 April 2025, the Trump administration issued an executive order to revive the US domestic shipbuilding industry and regain maritime dominance, especially in light of China’s rapid relative gains. The order underlines regaining the competitive advantage as a priority. It also highlights a pressing urgency in the current US administration about its slipping maritime dominance and shipbuilding capabilities vis-à-vis its major challenger, the People’s Republic of China.

A month earlier, on 13 March 2025, military veterans introduced the Save Our Shipyards Act to revitalise and renew the US maritime industry, emphasising the American military’s needs. Both these announcements point towards a realisation that the US must rapidly augment its maritime dominance, led by advances in the shipbuilding race, if it wants to sustain its preeminence in this domain. For reference, China has exponentially expanded its shipbuilding capabilities in the past two decades, accounting for 53 percent of global shipbuilding manufacturing.

China and Naval Shipbuilding Dominance

The global shipbuilding market has changed dramatically over the past two decades. In the 2000s, key US allies—South Korea and Japan—commanded 74 percent of the market, while China enjoyed a mere 5 percent share. By 2024, China’s market share rose to 53 percent, whereas South Korea and Japan’s combined share stood at 42 percent. The US accounts for less than 1 percent of shipbuilding activity globally today.

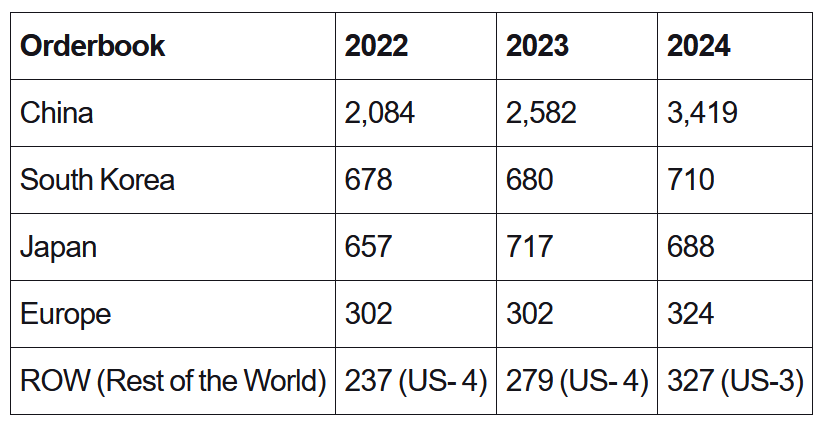

China’s progress in commercial shipbuilding has been awe-inspiring. Its rapid progress can be attributed to domestic manufacturing, low labour costs, an export-heavy economy, and government subsidies. The progress in naval shipbuilding has advanced at a comparable rate. Many shipyards function as dual-use production facilities, offering commercial and naval shipbuilding, as part of the government’s military-civil fusion that aims to eliminate barriers between commercial and defence sectors, yielding strategic and economic benefits. The table below highlights the gap in shipbuilding capabilities between China and other countries.

Table 1: Ship Orders Received (2022–24)

China’s ability to leverage its shipbuilding base for dual purposes has advanced its naval capabilities. The country possesses the world’s biggest maritime fighting force, operating 234 warships compared to the US Navy’s 219. Its naval expansion has been rapid, and numerically, the PRC today has the largest navy in the world with a battle force of over 370 ships and submarines, including more than 140 major surface combatants. The People’s Liberation Army Navy’s (PLAN) overall battle force is expected to grow to 395 ships by 2025 and 435 by 2030. Around 2005, the US Navy had a fleet of around 300, and China had around 200. Although by 2030, the US fleet size will remain the same, China’s will reach 450. When it comes to commercial shipbuilding, China’s shipbuilding industry has witnessed significant growth over the years, establishing a substantial lead over its competitors—including the US (as shown in Table 1).

However, the US shipbuilding industry may falter without any external impetus. Decades of underinvestment and protectionist policies have left the US shipbuilding industry lagging behind global standards. Its capacity pales compared to China’s, with the Navy’s shipbuilding process plagued by cost overruns, design flaws, and delayed deliveries. Private players play a major role in delivering the US Navy its required number of ships, but they have been over budget and behind schedule, besides being unable to meet the Navy’s goal of increasing its fleet size.

These challenges present a significant bottleneck for the US vis-à-vis its ability to upgrade its naval infrastructure. A faltering capability at sea has raised concerns about Washington’s ability to protect important sea lanes of communications and dominate chokepoints—vital for timely control of international trade during crises and protecting global trade routes—a core role of the US Navy.

Augmented Presence in the Indo-Pacific

China’s global rise as a maritime power has sharpened focus on its ambitions to control sea routes in its immediate neighbourhood and beyond. Its increased coercive activities in the Indo-Pacific have caused concerns among countries such as the Philippines, South Korea, and Japan, among others. The Pacific theatre—home to major US allies—is central to countering Chinese actions, making it a priority for the US to maintain a favourable balance of power. Additionally, Beijing’s growing belligerence against Taiwanese waters has fuelled uncertainty and urgency. In this regard, a recent briefing by the US Assistant Secretary of Defence for the House Armed Services Committee highlighted China’s increasingly aggressive behaviour. In particular, amplified military build-up and rapidly growing capabilities of China came under focus, stressing the need for the US to re-establish deterrence in the Indo-Pacific region.

The Arctic Front

For a comprehensive maritime dominance that America seeks, the Arctic waterway is turning out to be another critical front in this evolving competition. With climate change making navigation easier, China could be keen on potential economic opportunities in the High North. In partnership with Russia, it is developing shipping routes in the Arctic. A subcommittee of Russian and Chinese officials met in November 2024 to devise a cooperation strategy for developing the 3500-mile-long Northern Sea Route.

Icebreakers play a crucial role in maintaining year-round access to the Arctic. China recently deployed three icebreakers in Arctic waters, depicting its ‘polar ambitions’. On the other hand, the US is struggling with its icebreaker fleet, with its only remaining icebreaker nearing service end. In 2024, it partnered with Canada and Finland for the Icebreaker Collaboration Effort or Ice Pact, to enhance Arctic capabilities and counter increasing geopolitical activities in the region. At the beginning of 2025, Trump announced that the US would order 40 big Coast Guard icebreakers. Albeit highly unlikely, his focus on controlling the strategically located Greenland underscores the intensifying Arctic competition and the US’s bid to maintain its position in the region.

Way Ahead

The US faces an uphill task in reinvigorating its shipbuilding industry. Trump’s executive order rightly outlines Washington’s challenges—‘rectifying issues with shipbuilding manufacturing requires a comprehensive approach that includes securing consistent Federal funding, making US-flagged and built vessels commercially competitive in international commerce, rebuilding America’s maritime manufacturing capabilities (the Maritime Industrial Base), and expanding and strengthening the recruitment, training, and retention of the relevant workforce.’ For a rather inconsistent Trump administration, the challenges to America’s maritime revival include sustained funding, inter-agency collaboration, a realistic assessment of its relative capabilities compared to China, and a roadmap for the future to track its progress across various parameters.

Trump’s executive order to revive America’s maritime dominance for the US strongly underscores the urgency for building its capability to protect its interests in the long run. The US Navy’s bi-hemispheric focus is on enhancing its facilities to deal with evolving challenges in the Indo-Pacific, Latin America, and the Arctic. For addressing its commercial and strategic interests in a hyphenated way, rebuilding its decaying shipbuilding industry may signal a new beginning for Washington.