Morocco and Israel: Economic Opportunities, Military Incentives, and Moral Hazards

The December 2020 Moroccan-Israeli normalization deal has evolved from a vehicle enabling Morocco to gain long-sought U.S. recognition of its claims on Western Sahara to a broader strategic partnership with Israel. Geopolitically, the relationship provides clear benefits to both sides: for Morocco overt access to Israeli security and military cooperation, and for Israel greater acceptance, presence, and potential influence in North Africa. But the bond has already enflamed regional tensions as Algeria grows weary of the scope of Morocco’s military cooperation and its hardware purchases. The two North African neighbors need to find means of reaching accommodation, and the international community can play a key role in helping to build such opportunities.

Executive Summary

Main Takeaways

The December 2020 Moroccan-Israeli normalization deal has evolved from a vehicle enabling Morocco to gain long-sought U.S. recognition of its claims on Western Sahara to a broader strategic partnership with Israel.

Geopolitically, the relationship provides clear benefits to both sides: for Morocco overt access to Israeli security and military cooperation, and for Israel greater acceptance, presence, and potential influence in North Africa. But the bond has already enflamed regional tensions as Algeria grows weary of the scope of Morocco’s military cooperation and its hardware purchases.

Morocco and Israel have built their nascent alliance on shared history and population flows, and Morocco has relied on this history to promote normalization domestically.

The monarchy has walked a fine line, endorsing the alliance with Israel while vowing support for Palestinian rights and a two-state solution. The shift of Israeli politics to the right could complicate this, but it is not likely to derail the alliance.

Popular perceptions in Morocco of the normalization deal and bilateral ties are nuanced and provide a stronger reflection of more principled considerations among the public. It contrasts with the lack of domestic political effort to oppose the alliance and speaks to a complicated and evolving popular sentiment.

Israel provides an important benefit to the Moroccan military, which is eager to enhance its capabilities through access to Israeli technology, especially UAVs. Morocco increasingly views military cooperation with Israel as a potential deterrent to aggression from the Polisario Front (and, to a lesser extent, from Algeria). However, this posture and its recent arms purchase spree are compounding diplomatic tensions with Algiers.Policy Recommendations

An important goal for international partners and supporters with a direct or indirect stake in regional stability is to build opportunities and platforms through which Morocco and Algeria can engage. The two countries need to find means of reaching accommodation. Competition is inevitable, but it can take place in a healthy way. The international community can play a key role here in helping to build these opportunities around shared interests.Introduction

Since the Morocco-Israel normalization deal brokered by the Trump administration in December 2020, the two countries have signed a slew of over 30 agreements, accords, and memoranda of understanding spanning sectors ranging from security and intelligence to agriculture and water management.1 Several high-level visits and working delegations have shuttled between the two countries. Among the higher-profile aspects of the new bilateral relationship are the military and commercial elements, with military cooperation being undoubtedly the fastest moving. On Sept. 13, 2022 Gen. Belkhir el-Farouk, the inspector general of Morocco’s Royal Armed Forces (Forces Armées Royales, FAR), led a military delegation to meet with his counterpart Aviv Kochavi, who in turn had completed an earlier visit in July. Just about a year ago, in November 2021, Israeli Defense Minister Benny Gantz and his Moroccan counterpart, Abdellatif Loudiyi, signed a memorandum of understanding kicking off cooperation on a host of security issues, including arms purchases (especially of high-tech military equipment), joint military exercises, cyber security, and intelligence sharing.

Likewise, on the commercial and economic front, the collaboration has been extensive and is envisioned to bring foreign direct investment to Morocco and open up opportunities for mutual benefit. Cooperation has begun in earnest around issues such as water management and renewable energy as Israeli private businesses seek new investment opportunities in Morocco. In private, Israeli diplomats show happy astonishment at the embrace of their Moroccan counterparts. The normalization deal quickly turned into a “warm peace” and a mutual affection of sorts that sets this bilateral relationship apart from others.

Moroccan diplomats demure when their country is lumped into the Abraham Accords and are quick to note that their relationship with Israel predates that normalization.2 Historically, Morocco maintained ties to Israel through the large Moroccan diaspora that settled in Israel since the establishment of the Israeli state. Indeed, the two countries have had a long, if quiet, cooperative relationship on security, one that has notably inspired condemnation and controversy in parts of the Arab world. Furthermore, Rabat hosted an Israeli liaison office from 1994 until the intifada of 2000. But the normalization of 2020 ushered in a new level of engagement. Over the past year and a half, Moroccan-Israeli ties have expanded, encompassing strong military and security cooperation and promising commercial opportunities.

What the warmth of the partnership hints at is the speed with which these links have blossomed and the lack of hesitation on Morocco’s part in scaling up the partnership, which has created both opportunities and challenges. Israel has gladly followed Morocco’s lead in setting the pace, and both countries have come to see this as a strategically beneficial partnership. For Morocco, the deal has shifted from a vehicle enabling it to gain long-sought recognition from the United States of its claims on Western Sahara to a broader strategic partnership with Israel. Morocco also sees this relationship as helpful in boosting its ties with both the U.S. and the European Union, thus further diversifying the country’s foreign partnerships and playing an increasingly crucial role in national defense. More importantly, the partnership has the potential to shift the military balance with Algeria, especially at a moment when diplomatic tensions between the old frenemies have been at their worst in years.

The partnership provides clear benefits to both sides. It provides Morocco overt access to Israeli security and military cooperation, and a seat and a stake in regional discussions of shifting security dynamics. Morocco’s presence along with key security actors during the Negev Summit showcases the extent to which this partnership highlights new ambitions for Morocco’s foreign policy. As for Israel, greater direct peace with Morocco (as with other Arab governments) boosts its acceptance among Arab states and potentially within Arab publics. Furthermore, this relationship provides a particular presence and potential influence in North Africa, an arena that for Israel has been distant. But the bond, as it creates practical opportunities, leaves behind the crucial issue it was meant to further: the Palestinian question. This has already enflamed regional tensions in the Maghreb region, as Algeria grows weary of the scope of Moroccan-Israeli cooperation.

A Historical Foundation for a New Partnership

While normalization didn’t come until 2020, Morocco perhaps unwittingly paved the ground for it years prior. The Moroccan and Israeli governments have rooted their vigorous pursuit of normalization in shared history and population flows. Part of Morocco’s rationale for normalizing ties with Israel is based on its Judaic history. The country has been shoring up its relationship with Jews of Moroccan descent — there are an estimated 1 million Jews who are Moroccan or of Moroccan descent — by re-invigorating historical narratives that weakened or were lost over the decades. Rehabilitating this part of Morocco’s history has been an element of a broader national effort predating normalization to rebuild a culturally and religiously tolerant society under an inclusive monarchy that commands all the faithful, including Muslims, Christians, and Jews.

Looking back two decades, in its quest to ease the growing radicalization that led to the May 2003 suicide bombings in Casablanca — the worst terrorist attacks in the country’s history — the monarchy adopted a holistic religious revision coupled with a hard security approach. The plan on the social and religious front was meant to remind Moroccans that Salafism, takfirism, and radical ideology are not indigenous to the North African country’s practice of Islam. Part of this effort was an attempt to refamiliarize Moroccans with a religious past that, however conservative it might have been, did not violently reject others. In that sense, the monarchy sought to bring back a more Sufi take on Islam and to emphasize the history of religious acceptance.

Efforts to showcase the co-existence of Muslims and Jews turned into a celebration of the country’s Jewish history as an example of said tolerance. Drawing on the contributions and importance of its Jewish population in various domains has provided somewhat of a natural first step for normalization from the leadership’s perspective. Historically, Morocco’s Jewish population was a minority, accounting for less than 10% of the total population at its peak. There was a major exodus after World War II and into the post-independence period, as Jewish communities from all over the Middle East and North Africa flocked to Israel. Morocco was one of the main departure points, with an estimated 130,000 Jews leaving the country from the late 1940s to the early 1960s. Various factors played a role in this exodus, beyond the establishment of Israel as a Jewish homeland, including incidents of anti-Jewish violence and broader concerns within the Jewish community about their future in the country after independence. In 1948, pogroms in Oujda and Jerada catalyzed Jewish exodus from Morocco.

Today, according to the 2021 U.S. State Department Report on International Freedom, there are between 2,000 and 3,500 Jewish Moroccans, who report exercising their religion unhindered. Religious minorities in Morocco include members of various diaspora groups residing in the country, as well as those who have adopted Shiism or converted to Christianity. These minority groups, unlike Moroccan Jews, face official harassment and curtailment of freedoms. Initiatives to emphasize the country’s Jewish heritage have grown as the leadership sought to invigorate ties with the Jewish population of Moroccan descent. Among the various elements of this effort are renovations of Jewish cultural and religious sites, including synagogues, cemeteries, and Jewish quarters, which in Moroccan cities are referred to as Mellahs. This effort, which has gone on for about a decade, has recently picked up steam. In December 2021, King Mohammed VI announced an initiative to restore and renovate hundreds more cemeteries and synagogues. Other efforts to streamline and institutionalize Jewish heritage and links to the Moroccan Jewish diaspora include the creation of three bodies to manage diaspora affairs and streamline ties and exchanges: the Federation of Moroccan Judaism, the National Council of the Moroccan Jewish Community, and the Commission of Moroccan Jews Abroad.

The promotion of a broader popular understanding of the role of Judaism in contemporary and historical Morocco also includes featuring Jewish history in the public school curriculum. These initiatives, mainly bureaucratic and symbolic, have brought to the forefront the extent to which the Moroccan leadership wants to revalorize the role Jews and Judaism have played in the kingdom. Furthermore, there is an effort not to relegate this to one chapter or period, but rather to view it as an inherent part of Morocco’s history. As is often the case, this effort has not always led to a full and honest reckoning of the true scope of history, including its ugly side.3 Yet there is a rich history that is being explored to focus on a more tolerant reality to which the government and the people can strive, as well as to appeal to the Jewish diaspora — hundreds of thousands of Israelis, among whom are tourists, consumers, and potential investors.

The reception in Morocco of these efforts has ranged from ambivalence to passive support. Most Moroccans do not oppose a clearer understanding and revalorization of their country’s Judaic history, so long as it does not stand in competition or contrast to the dominant religious experience. Indeed, many Moroccans speak fondly of their experiences growing up in Jewish neighborhoods and or at times trace some of their own familial history to some Jewish remnant. While it can be difficult to separate reactions to normalizing the Jewish history of Morocco from normalization with Israel, as in retrospect one helped pave the way for the other, this aspect of Moroccan history and culture has not been the subject of much controversy or opposition.

The key issue the monarchy has had to sidestep, though, is that while embracing Morocco’s Jewish connections may not unsettle the values of most Moroccans, doing so at the expense of the Palestinian question is a thornier matter. The Moroccan monarchy has effectively put aside any concerns about the Palestinian question. Given its limited role, that has not been costly choice. Furthermore, for Morocco the Palestinian issue is neither one of national identity nor one of immediate geographical proximity. At the monarchy level, Morocco’s king has had a limited role chairing the Al-Quds Committee, one of the four standing committees of the Organization of Islamic Cooperation working to safeguarding Arab-Islamic heritage in Jerusalem. At the political level, leftist and Islamist parties in Morocco have often made the liberation of Palestine and support for Palestinian rights part of their discourse, if not platforms. On the popular level, there is solidarity with the cause, particularly among older generations. However, among younger Moroccans, who have less of an ideological commitment to their parents’ causes, many don’t see the Palestinian issue as their battle to win or lose.4

While Morocco continues to support a two-state solution, its recent embrace of Israel necessarily limits the Palestinians’ room for maneuver, making the issue less and less a question of Arab-Israeli peace. Through this bilateral partnership, and others, Israel is not only gaining peace but also stronger commercial and security ties across the Arab world, without resolving the Palestinian issue. The Moroccan monarchy has claimed that peace with Israel need not mean turning its back on the Palestinian cause. But such claims mean little, as Morocco has always kept its distance from the issue. Few examples exist of the Moroccan leadership endeavoring for Palestinian rights. In July 2022, Morocco was credited with helping achieve a deal with Israel to open the Allenby Bridge border crossing to Jordan to ease the systemic travel restrictions facing Palestinians. This is one of a few examples that would help justify the rationale that Arab actors are better positioned to negotiate on behalf of the Palestinians if or when they accept Israel.

The impending government change in Israel could test the fine line the monarchy is walking regarding the alliance with Israel versus support for Palestinian rights. The results of the recent Israeli elections and the continuing shift of Israeli politics to the right will likely undermine one of the core tenants of the Abraham Accords, a halt to annexation. Yet, the rise of extreme-right figures within the Israeli government, including those known for racist rhetoric and calls for deportation laws and annexation like Itamar Ben-Gvir, is not likely to undo or halt this alliance. The scope of ambition for investment and military partnership has grown too important for Morocco to put aside. The area where this might play out is in shifting popular perceptions of normalization and Morocco’s alliance with Israel.

The Impact of Popular Perceptions

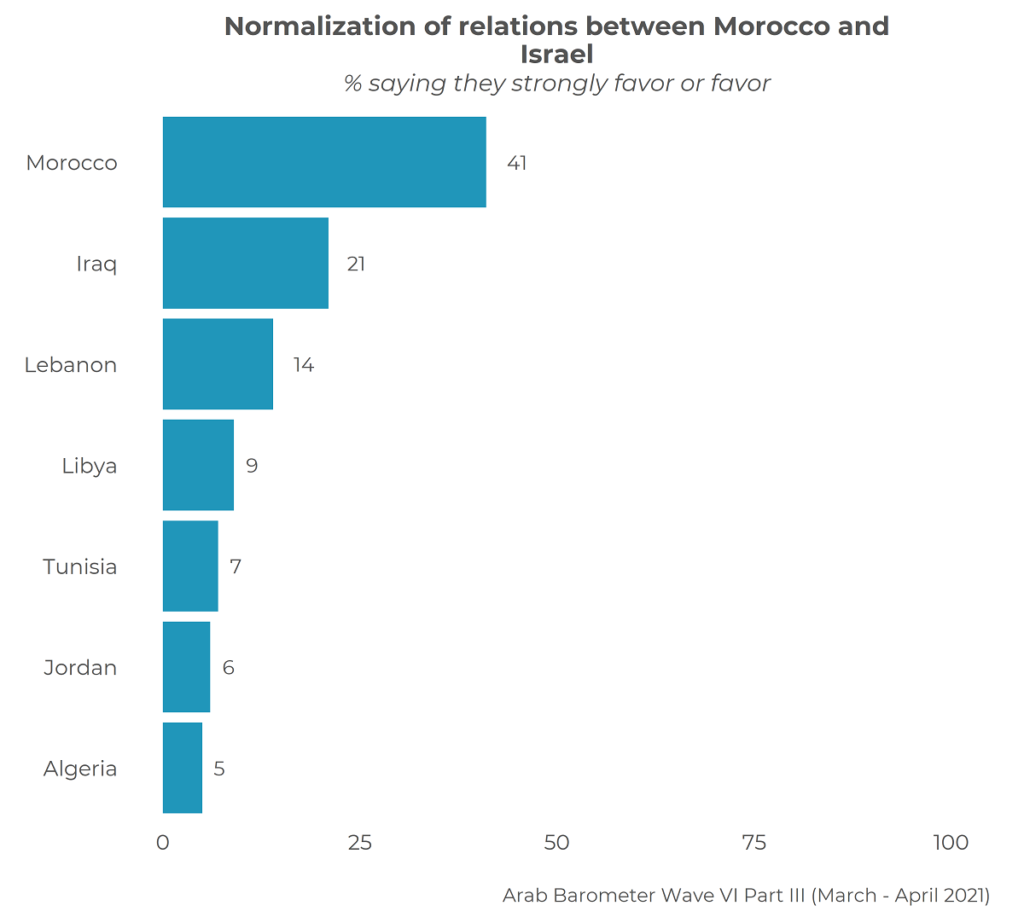

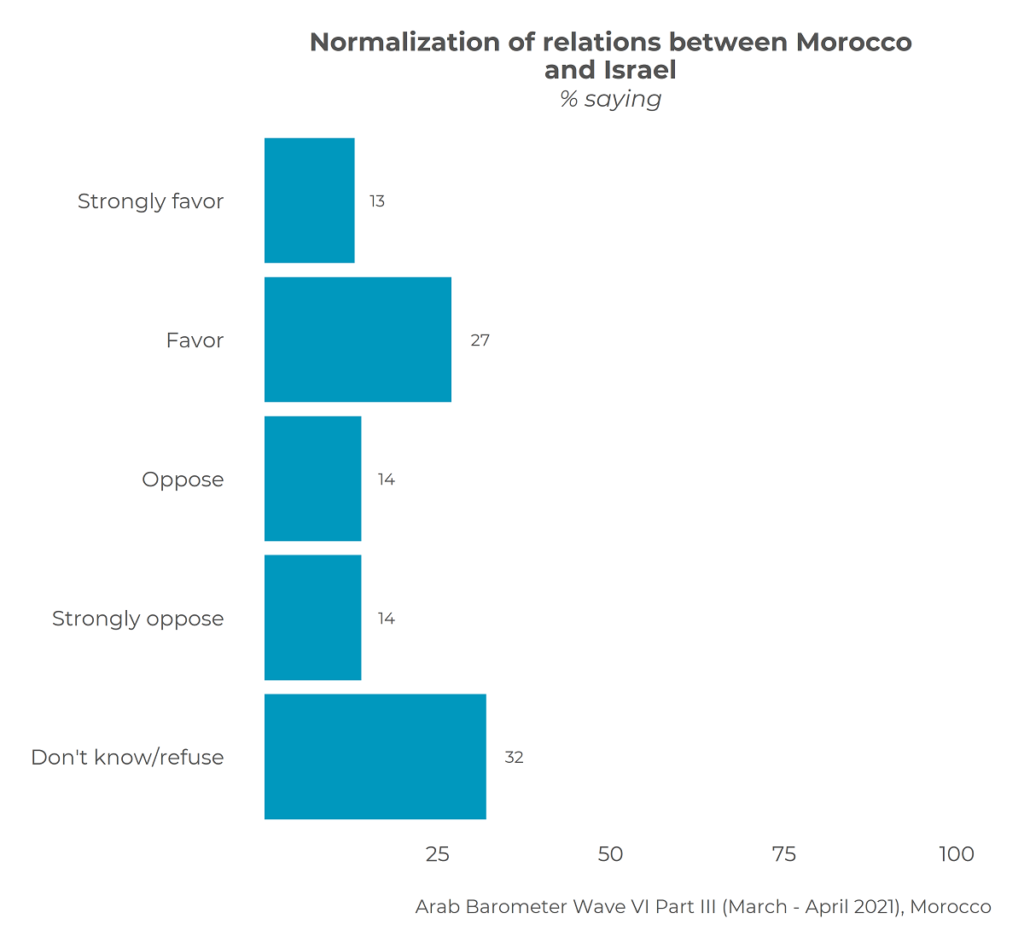

In a country like Morocco where the monarchy dominates decision making, the role of public opinion is rather limited, but the evolution of popular perceptions of normalization gives a sense of conflicting public sentiment, unlike the position of the government. In 2021, the Arab Barometer survey found, when polling Moroccan public opinion, greater acceptance of normalization with Israel than in other countries.

The Moroccan monarchy, which closely runs foreign affairs, has paved the way for this despite opposition from the Justice and Development Party, then the leading party in government. Billed as an extension of Morocco’s religious and cultural tolerance and a pathway to economic benefit, the bilateral deal met with limited popular resistance.

The key to this limited opposition at the time was, of course, the Western Sahara component. The deal was brokered by the Trump administration as a quid pro quo, although in the end the U.S. recognition of Western Sahara was subsequently watered down under the Biden administration. From both a popular and a political perspective, no matter how committed the Moroccan public might be to opposing Israel on the grounds of the Palestinian conflict, they are far more committed to Morocco’s sovereignty over Western Sahara. The U.S. recognition of what most view as Morocco’s rightful territory has long been a point of frustration among a public conscious of the strength and history of U.S.-Moroccan ties.

Due in large part to this bundle deal, efforts to mobilize against normalization were limited and mostly led by non-official political actors, like the banned Islamist group Al Adl Wal Ihsan, or Justice and Charity. Though long-time supporters of Palestinian rights, Al Adl Wal Ihsan’s base did not mobilize on the scale they typically do, in part because of the quick and early crackdown on efforts to organize protests, under the pretext of the COVID-19 pandemic. The issue was also simply not as relevant to a population facing significant domestic economic concerns, ones that a normalization deal could potentially help ease by facilitating incoming investment and economic growth.

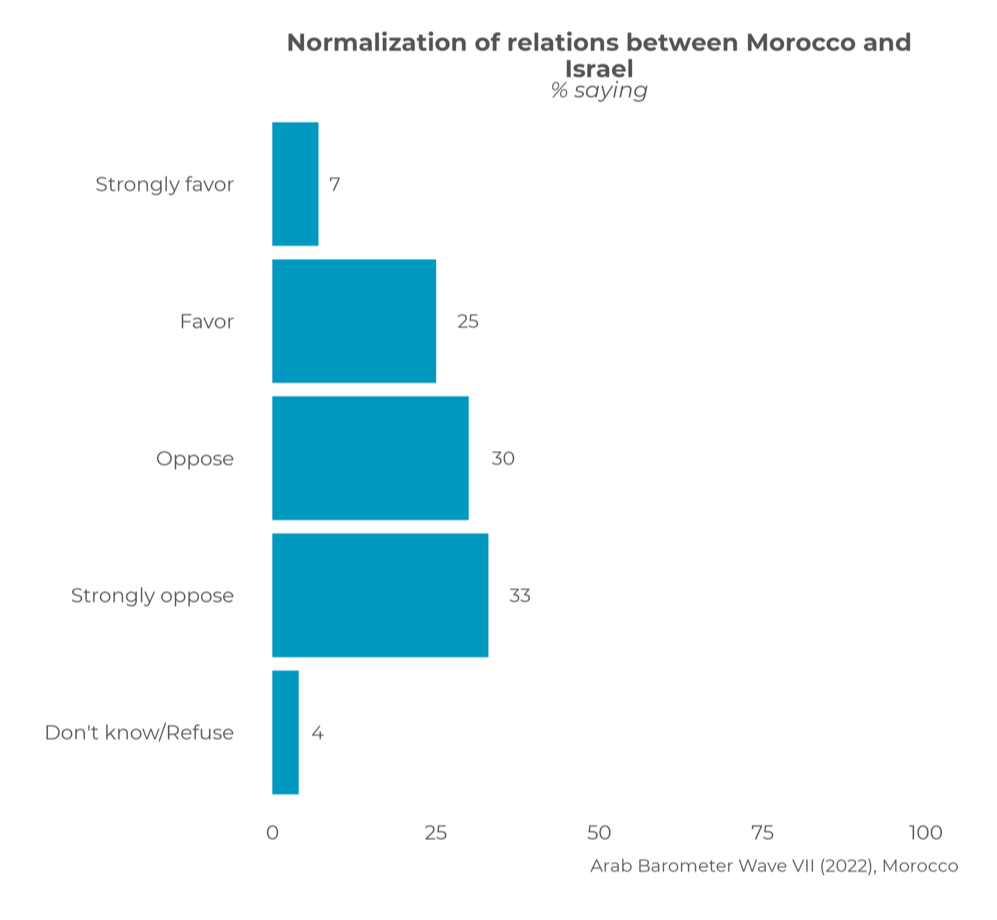

More recent polling, however, shows a changing picture among the Moroccan public and less ambivalence, with the number of those who don’t know decreasing from the previous poll, and the percentage of those who oppose it overtaking those who favor the deal domestically.

One aspect of the burgeoning ties between Morocco and Israel that has drawn domestic criticism is Morocco’s alleged purchase and use of Israeli technology firm NSO Group’s Pegasus spyware. Although the alleged use of the spyware as documented precedes the normalization deal, its potential impact on Moroccan politics is helping to shift perceptions of the alliance. Critics of the government, particularly journalists, have borne the brunt of the state’s spying and faced crackdowns, intimidation, and even harsh jail sentences and fines. Two key non-governmental organizations (NGOs), Forbidden Stories and Amnesty International, have detailed lists of people targeted, particularly inside Morocco. Internationally, the list of targets has included such high-profile figures as French President Emmanuel Macron, in an incident that has dealt a real blow to bilateral relations and trust. The list also included the Spanish prime minister and a range of Algerian targets — the discovery of which was part of what led to the rise in diplomatic tensions and the ultimate break between the two North African neighbors in August 2021.

Another element in the shifting popular perception is the recent allegations of sexual abuse and misconduct by David Gorvin, the head of the Israeli liaison office to Morocco, toward Moroccan workers employed there. Some Moroccan NGOs have sought to mobilize around the issue and to revive earlier calls to reject Israel and the normalization deal. Still, political actors have not demonstrated a sustained or deeper opposition for several reasons: First, it would have gone against the kingdom’s proclaimed values of tolerance and inclusion, and second, it would have been a losing effort politically as the impetus for the alliance is driven by pragmatic considerations from the U.S. position on the Western Sahara to ambitious economic and military cooperation agendas.

In Search of Israeli Investment

Within months of the signing of the normalization deal, in July 2021, Israeli airlines introduced the first direct commercial flight from Marrakech and Casablanca to Tel Aviv. Then-Israeli Foreign Minister Yair Lapid, during a visit to Rabat in August 2021, inaugurated a liaison office, open once again after closing following the Second Intifada. An agreement to build an ambassy in Rabat was signed in August 2022, and plans for cooperation continue in many areas, including trade, defense, and security.

Economic cooperation deepened in 2021 with a mushrooming of deals to expand trade and economic exchange in line with how the Moroccan leadership has spoken about the benefits of the deal for the population. According to outgoing Israeli Minister of the Economy Orna Barbivai, the aim is to increase trade from a reported $131 million in 2021 to $500 million in five years. This is not likely to alter the current structure of Morocco’s trade, but it marks the growth expected year to year. One more notable aspect of this growing relationship is labor export: Morocco agreed to send workers to Israel to take up jobs in areas that face shortages, namely the construction and nursing sectors.

Another important aspect is cooperation on water management and agriculture, where Moroccan farmers at all scales are looking to build adaptive farming capabilities. The joint “Connect to Innovate” May conference organized by the Israeli NGO Start-Up Nation Central, which promotes the Israeli innovation ecosystem, resulted in a series of cooperation agreements, especially in agriculture. Morocco is additionally keen to draw on Israeli support and expertise in climate change mitigation strategies. Some of these efforts included water management: Morocco has concluded deals to build desalination plants managed by Israeli firms. Science and technology cooperation and joint ventures have also focused on agricultural resilience and renewable energy, in addition to pharmaceutical and biotechnology research. Overall, while trade between the two countries grew in 2021, so far the rate of increase has been less than expected. Per Israeli calculations, bilateral trade reached $69 million in the first six months of 2022, only a 1% increase from the same period of the previous year.

The two partners are gradually developing this nascent relationship into a rich, multidimensional partnership, despite the limited trade volume to date, but nothing illustrates this ambition more than defense and military cooperation.

National Defense and Military Cooperation

Before delving into Morocco’s growing military and security ties with Israel, it is important to understand the context within which Morocco’s military operates and its key advantages and vulnerabilities. The kingdom’s modern army has been shaped, first and foremost, by its relationship with the palace and successive monarchs. In the aftermath of the country’s independence in 1956, the institution was fully subordinated to the monarchy following two failed coups in the early 1970s, and its devotion and loyalty to the palace have not been in question since.

The military has fought two key opponents on its borders over the past six and half decades: the Algerian army and the Polisario Front. Shortly after Algeria’s independence, Morocco and Algeria fought a brief border war in 1963. This conflict was the original sin and became a powerful defining moment that shaped Algeria’s military doctrine and would mark Morocco as its closest and most dangerous enemy due to its expansionist ambitions. The dynamics that led to this war and the rivalry that arose out of it continue to this day, shaping both countries’ foreign policy agendas and geopolitical considerations. The dispute over Western Sahara fits within this rivalry — even if it did not start as part of it, it has continued as a result of its outcome.

The dispute among Morocco, Algeria, Mauritania, Spain, and the Polisario Front over who has the legitimate right to control the Western Saharan territory persisted as a regional conflict in search of political solution; but in the late 1970s and 1980s, the conflict experienced the growth of the military aspect. Of particular relevance here, the Moroccan military fought an insurgency war against the Polisario Front, the U.N.-designated representative of the Sahrawi people who claim sovereignty and ownership of the former Spanish colony of Western Sahara and whose government in exile, the Sahrawi Arab Republic, is based in Algerian refugee camps. Morocco’s army, the FAR, contributed to several other missions, but the conflict with the Polisario and the Western Sahara issue was its main concern while active hostilities continued, from 1975 until the U.N. brokered a ceasefire in 1991. The ceasefire lasted until November 2020. In the meantime, however, the Moroccan army continued to expand and modernize, growing in sophisticating, training, and equipment. The Polisario, with its limited capabilities, is not Morocco’s main military concern today.

Since the U.N.-brokered ceasefire between Morocco and the Polisario Front collapsed, Morocco has admitted to few casualties and allowed reporting of none. Polisario strikes have not incurred significant damage on key structures. Rumors and unofficial reports of minor damage to the berm — a 1700-mile-long, largely sand structure running through the Western Sahara, separating Moroccan-controlled and Polisario-held territory — and some casualties have been floated since fighting resumed.5 Meanwhile, Morocco has reportedly carried out several drone strikes targeting Polisario personnel and vehicles. In November 2021, tensions between Morocco and Algeria increased when the latter announced that Moroccan drone attacks in the buffer zone (and into Polisario Front-held territory that is referred to as No-Man’s Land) at the Mauritanian border resulted in the deaths of three Algerian nationals. The Polisario has, by their count, incurred substantially more casualties, while their military capabilities have presumably remained the same.

While information about Polisario combat capabilities is not readily available and difficult to verify, reportedly the group’s arms are largely limited to what it managed to acquire during the Gadhafi era — supplies that include, according to French sources, 4x4s outfitted with anti-aircraft guns, rocket launchers, 120-millimeter mortars, and Soviet-made T-62 and T-55 tanks. The Polisario has also long been rumored to operate materiel seized or raided from the Moroccan army. According to unverified reports, Algeria has supplied the Polisario with surface-to-air missiles and armored vehicles. Speculation about whether Algeria is willing to provide the Polisario with more advanced weaponry — either directly or by allowing it to receive such weapons from other sources — does not withstand scrutiny, given the domestic implications of allowing the group to grow more militarily powerful while still largely housed within Algerian territory.

Algeria, a major buyer of Russian arms, showcased some of its latest Russian hardware purchases during the al-Hazm military exercise conducted around Tinduf in January 2021. The cost of the equipment on display was estimated at around $100 billion, all acquired over the past 10 years, including Sukhoi Su-30 fighters, T-72 tanks, Mi-35 helicopters, and Iskander missiles. An estimated 70% of Algerian arms purchases come from Russia, with the remainder from Germany and China. The Algerian military is also rumored to have purchased S-400 missile defense systems from Russia. Although Algeria maintains military superiority in North Africa — it is the largest purchaser of arms in Africa — Morocco has continually tried to compete, not on the dollar amounts spent, but on the efficacy and sophistication of its military institutions and personnel, and increasingly on the strategic choices of hardware purchased. And it is within this context that Morocco’s military ties with Israel must be understood — as well as Algeria’s suspicion of these ties.

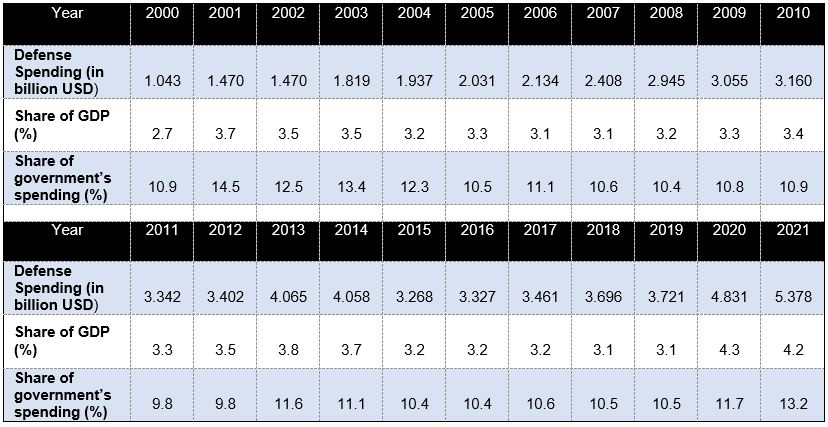

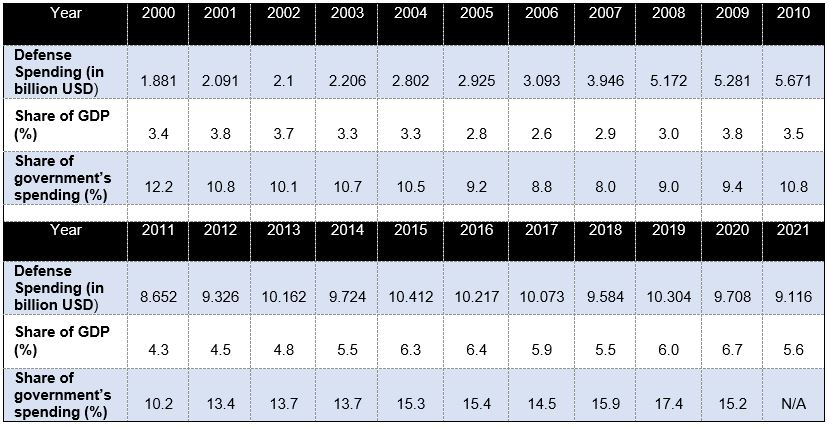

Although Moroccan officials play down the possibility of an armed confrontation with Algeria, they are keenly aware of Algiers’ superiority in arms and equipment and its increases in spending on armaments, which have ticked up steadily since the mid-2000s. Morocco’s own military spending has continued to grow as well. Both countries have among the highest military expenditure per capita in their part of the world: Algeria is the second and Morocco comes in fifth. This is in line with the broader pattern of increasing military spending across the Middle East, but the implications for their own neighborhood merit a closer look. The choice to spend more heavily on armaments and the general over-securitization often come at the expense of more pressing budgetary needs, such as service delivery, particularly of healthcare, infrastructure, and education. While the tension between prioritizing geopolitical and domestic concerns is perhaps no less acute, in this case the ability to spend at the rates Morocco and Algeria do indicates much less need to justify it. Algeria’s defense spending went from about $2 billion a year in the early 2000s to an average of $10 billion a year for the past five years. Morocco’s defense spending reached roughly $5 billion this year, the highest level yet, and it too has gradually increased over the past decade, from $3.5 billion in 2016 to $5 billion in 2022.

Morocco’s military expenditure throughout 2000-2021 as per SIPRI

Algeria’s military expenditure throughout 2000-2021 as per SIPRI

Morocco maintains an advanced cooperative relationship with U.S. military institutions and has a long history of acquisition and interoperability with the U.S. and French armed forces. It has long been a recipient of U.S. military support and has been approved for various arms sales agreements. Rabat has received different forms of U.S. military assistance, including Excess Defense Articles (EDA) and Foreign Military Financing (FMF) initiatives, through which it has obtained about $10 million annually since 2017, an increase from previous years. FMF funding allows recipient countries to access grants and/or loans that can be used for training, services, and purchase of defense articles. In 2019, the Trump administration approved an upward of $10 billion arms deal with Morocco; and in 2020, President Donald Trump put forth for congressional approval a further $1 billion deal for the purchase of precision-guided weapons and drones. This deal came after the Trump administration changed its position, that same year, on the Missile Technology Control Regime, which governs sales of drone technology, to be able to sell it to more countries.

Although Morocco already has strong military partnerships with the U.S. and the EU, Israel provides an added benefit to a military keen to improve its abilities. Morocco’s access to Israeli technology, unmanned aerial vehicles (UAVs) in particular, allows it to leapfrog ahead in enhancing its military power. The use of UAV technology is not globally regulated, with drones readily available from the right partners (Israel, Turkey, etc.), and it is relatively cheap. Media reports about Morocco’s latest acquisitions paint a picture of ambitious purchases focused on drone technology. However, according to industry experts, Rabat’s diversification efforts run the risk of accumulating a hodge-podge of technologies that requires different maintenance standards and approaches and could create coordination challenges.6 Morocco’s drone acquisition from Israel is reported to include five different types of units: Heron, Hermes 900, WanderB, ThunderB, and Harfang (specifically outfitted for France and subsequently purchased from it through EDA). In 2014, France brokered the purchase from Israel of three Heron drones made by state-owned Israel Aerospace Industries (IAI) for $50 million. Since normalization, Morocco has purchased a batch of Harop drones for $22 million in 2021. Known as Kamikaze drones, these can fly for up to seven hours while carrying 20 kilograms of explosives.

Morocco is also reported to have acquired the Chinese-made CAIG Wing Loong I and the Turkish made Bayraktar TB2. The latter are reported to have been used in an operation targeting Polisario personnel in 2021. From the U.S., Morocco has apparently bought the MQ-A1 Predator and MQ-9B SeaGuardian. Per a recent Forbes report, Morocco’s purchase of the latter, if used together with the TB2 acquired from Turkey, would help the Moroccan army overcome Algeria’s S-300 Russian missile defense systems, and potentially its S-400 systems as well. In terms of the military balance, one clear goal of these purchases is their deterrent value. Algeria boasts one of the strongest and largest navies in Africa and one of the most powerful air forces. Another important aspect is the political calculations, which seem focused on elevating the security dimension of Morocco’s regional ambitions and role, to fit in with its diplomatic and economic aspirations.

Last year the FAR also acquired five of Israel’s Skylock Dome counter-drone systems after the latter was first shown at Abu Dhabi’s 2020 International Defense Exhibition and Conference (IDEX). More recently, this past February, Morocco finalized a deal with IAI to buy the Barak MX integrated defense system for $500 million. This aerial weaponry protection system is effective against missiles and drones. It includes three different types of interceptors: Barak-MRAD, Barak-LRAD, and the Barak-ER. For Morocco’s part, as its arms spending spree continues, its goals seem to have evolved to include developing its own drone production technology. The military cooperation deal with Israel included a plan for the construction of two UAV factories in Morocco to produce Harop drones. Developing air defense industries could build upon the country’s existing aerospace industry and could become a lucrative endeavor for those involved, especially the military and the monarchy’s tight circle of economic partners and beneficiaries.

However, none of this bodes well for regional predictability. The security dilemma is present in the slippery slope between ensuring adequate defenses and deterrence and creating a heightened perception of Morocco as an acute threat to Algeria. As it stands, Algeria’s military doctrine already identifies Morocco as an aggressive expansionist threat. This belief is based on Morocco’s past action in Western Sahara, and prior to that, the border war of the early 1960s. This is what drives a segment of the military leadership, including Chief of Staff Saïd Chengriha. Morocco’s growing relationship with Israel is aimed at bolstering its position in the region, particularly in relation to Algeria’s, and is intertwined with Algiers’ desire to push back against Rabat’s position in Western Sahara and its geopolitical ambitions. Such preconceived notions contribute to and compound the heady diplomatic tensions between the two highly armed countries.

Morocco and Algeria may well find themselves facing heightened tensions, particularly given the enflamed rhetoric and lack of efforts to deescalate. Algeria’s discomfort and fears about Morocco’s military shopping spree have also been reflected in its own recent purchase of Turkish drones, announced in October 2022. Algeria could be considering greater diversification as its main military partner, Russia, faces crippling sanctions that could impact its defense industry and limit its ability to supply Algeria. Moreover, the extent to which Ukrainian forces have been able to successfully use Western and Turkish weapons against Russian hardware has further damaged the reputation of Russian arms and sharpened the perceived need to diversify purchases.

It remains to neither country’s benefit to pull the other into an armed confrontation. Both Morocco and Algeria are keen to maintain their domestic stability. After nearly two years of transition, Algeria has reached a moment of stable management of the country. More crucially, with Europe looking to reduce its reliance on Russian natural gas, Algeria is now one of the key sources for the bloc and instability would jeopardize the predictability of gas supplies. Likewise, Morocco is a promising emerging market and is eager to ramp up its investments and burnish its image as a haven of stability and prosperity. Instability on their borders hampers these narratives and is enough to make both countries think twice about a reckless confrontation.

That said, each benefits from charged and even hostile rhetoric toward the other — which galvanizes popular support and justifies growing military preparedness. Since the diplomatic break in August 2021, there have been no communication channels between the two governments, both of which feed off a long history of animosity, mistrust, and mutual dislike. With all of this — the arms race, the easy access to potentially destructive technology, and the hardening rhetoric from the government and the people’s side — there is room for miscalculation, even if consciously neither neighbor wants to engage in an armed confrontation. Escalation could play out in the form of a military exercise gone wrong or another drone attack targeting the Polisario that triggers an Algerian response or a stronger military retaliation by the Polisario itself — which would require access to more powerful military equipment than the group is currently reported to have. At the very least, the inflated military budgets further empower these institutions and have potential implications for their roles in domestic politics, the economy, and public perception.

What Next?

Morocco’s participation in the Abraham Accords has evolved from an initial focus on ensuring U.S. recognition of Western Sahara to a burgeoning cooperative bilateral relationship with Israel. In most respects, the ambition for this relationship extends well beyond its current status, which is relatively small, especially in trade. For Israel, this relationship, like those with the other Abraham Accords signatories, grants it the regional acceptance and integration it has long sought. It shifts the narrative around engagement with Israel away from the Palestinian conflict and Arab-Israeli peace to practical matters, like investment, defense, and security.

Morocco is keen to use every aspect of the relationship to its advantage: to signal its alignment with the Israel-U.S. axis against Iran and ensure a spot for itself in regional discussions (such as during the Negev Summit in spring 2022), even though its role in a new regional security architecture would likely be limited; to diversify its international partnerships and gain more influence with its U.S. and European allies; and more immediately, to draw a harder line against Algeria (and by extension the Polisario Front) if diplomatic tensions or the threat level increase.

Morocco and Israel have clear aims for the relationship. The key challenge is its impact on regional stability, largely how it contributes to Algerian suspicion of and animosity toward Morocco. This animosity is based history and conflict that far predates Israel-Moroccan partnership. But the moment highlights the need for broader efforts to, if not address the animosity and suspicion, at least to lower the tensions around it. Since the ceasefire between Morocco and the Polisario that held for decades came undone in November 2020, fears of potentially destabilizing incidents have grown. And a key avenue to address those, in addition to the Western Sahara conflict negotiations under the auspices of U.N. Special Envoy Staffan de Mistura, is laying the groundwork for greater understanding of the role of Morocco and Algeria in the region and its projection in Africa.

An important goal for international partners and supporters with a direct or indirect stake in regional stability is to build opportunities and platforms through which Morocco and Algeria can engage. The two countries are likely to remain the main heavyweights in North Africa and the Sahel and they need to find means of reaching accommodation. Competition is inevitable, but it can take place in a healthy way. Opportunities for dialogue at all levels — governmental, civil society, security, and military — are curtailed at this point, and new ones must be created. The international community can play a key role here in helping to build these opportunities around shared interests. Such efforts can be conducted through mediation, behind-the-scenes dialogues, and even simply opportunities that bring actors from these two countries together. With the support and prodding of international partners, be they the U.S., EU, or regional actors with ties to both, Algeria and Morocco can help to lower tensions, pave the way for shared economic and security interests, and ensure mutual benefits. They are unlikely to do this without outside help.