Asia’s Push For Monetary Alternatives – Analysis

SUMMARY

For the last quarter century, Asia has been seeking greater autonomy within the existing international monetary system. While the region has had the resources to go its own way, intraregional rivalries and a reluctance to damage ties to the US and the International Monetary Fund have put a damper on regional initiatives. Now the ascendency of China offers a path toward greater regional autonomy in monetary affairs. Asia, led by China, has been playing a two-track strategy pushing for greater influence within the existing global institutions, while developing its own parallel institutions such as the Chiang Mai Initiative Multilateralization, the Belt and Road Initiative, and the Asian Infrastructure Investment Bank. Use of the Chinese renminbi will likely grow as a trade invoicing currency but expanded use of the renminbi as a reserve currency is more uncertain. It is possible that the dollar-centered international financial system could evolve into a multipolar system with multiple currencies playing key roles.

For the last quarter century, Asia has been seeking greater autonomy within the existing international monetary system. While the region has had the resources to go its own way, intra-regional rivalries, and a reluctance to damage ties to the US and the International Monetary Fund (IMF), have put a damper on regional initiatives. Now the ascendency of China offers a path toward greater regional autonomy in monetary affairs. How much influence China commands will depend on policy decisions in Beijing and the future trajectory of China’s economic development.

A Quarter Century of Disappointment

Asia’s dissatisfaction with the existing international monetary order dates to the Asian financial crisis of 1997-98. The status quo has its origins in the Bretton Woods system devised in 1944, which created the Western-led IMF and World Bank and confirmed the dollar’s role as the key currency. Even after the dollar’s convertibility to gold was suspended in 1971, the dollar continued to function as the benchmark currency in the market-driven system.

This system came under strain as the world economy evolved further away from the political and economic conditions of the postwar period. The expansion of cross-border finance meant a need for increasing resources for the IMF to play its role of lender of last resort safety net or backstop role, and the growing importance of emerging markets was accompanied by rising demands for a greater Asian voice within these institutions.

It was against this backdrop that the Asian financial crisis erupted in July 1997. Multiple Asian countries experienced enormous contemporaneous falls in output and employment. In Indonesia, the Suharto regime fell. The IMF, accustomed to Latin American-style balance of payments crises rooted in fiscal profligacy, initially followed a cookie-cutter approach, demanding budget cuts in the face of what was fundamentally a financial (i.e., based on poor choices by corporations and governments), not fiscal (inability to manage debt), crisis. To the Fund’s credit, it quickly changed tack, but the damage had been done: the photograph of IMF Managing Director Michel Camdessus standing arms folded over Suharto as he signed his country’s agreement with the Fund became a symbol of Asian subservience. In Korea, the economic upheaval came to be known as “the IMF crisis.”

The collective response of the Asian countries was to say “never again,” and to begin accumulating current account surpluses as a means of self-insurance. Again, to its credit, the Fund rethought some of its ideas about capital account liberalization and constructed a pre-approval mechanism that would allow fundamentally sound countries to borrow without negotiating elaborate bailout packages. But the Asians remained nevertheless wary of the “stigma” associated with IMF deals.

For its part, Japan proposed an Asian Monetary Fund (AMF) as an alternative to the IMF. But the US and the IMF opposed it, China remained noncommittal, and the proposal died. While the AMF was stillborn, in 2000 an ASEAN borrowing agreement evolved into the Chang Mai Initiative, an embryonic regional exchange rate stabilization fund.

Not much changed until 2007, when the world was engulfed in a Global Financial Crisis emanating from the US and Europe. Asia was adversely impacted through both capital market and trade linkages. This time, however, Asians were reluctant to go to the IMF, and mobilization of regional resources was constrained by Japan-China rivalry. What emerged was a tendency to draw down on the surpluses that had been accumulated over the previous decade, and to pursue national interest through individual paths: Southeast Asia looked to Northeast Asia for support; Korea looked to the US in the form of a swap line with the US Federal Reserve; and Singapore talked up ASEAN solidarity, but similarly looked to the Fed for a swap commitment.

Historically, Asian governments have been hesitant to commit to binding agreements or strong regional institutions, but the experience of the Global Financial Crisis convinced Asian policymakers to redouble their efforts. That work yielded the Chiang Mai Initiative Multilateralization (CMIM), a $240 billion fund, 40 percent of which can be drawn upon without linkage to any IMF program. A macroeconomic surveillance unit, the ASEAN + 3 Macroeconomic Research Office, was established in Singapore.

At the same time Asia was exploring alternative institutions it was also trying to increase its voice within the existing ones. Initiatives to reform the Bretton Woods institutions arose in the wake of the Global Financial Crisis. At the IMF, this involved an overall quota increase to provide the Fund with more resources, together with a rebalancing of quota subscription shares to increase the representation of emerging markets, including those in Asia. At the World Bank, a 2009 report by former Mexican president and central bank governor Ernesto Zedillo called for an increase in developing country influence, an abolition of the resident board system, an increase in lending capacity, a refocus on infrastructure, and a streamlining of environmental and social safeguards to speed project implementation.

In the event, the US Congress dragged its feet on approving the IMF quota increase and the share rebalancing, and the Zedillo Report recommendations went unheeded. Into this void stepped China with the Belt and Road Initiative (BRI) in 2013 and the Asian Infrastructure Investment Bank (AIIB) in 2016.

Chinese overseas lending, centered on but not limited to the China Development Bank and the EXIM Bank, expanded enormously, and now stands at roughly $85 billion annually, exceeding lending by the World Bank, the IMF, and the Paris Club of Western official lenders combined. From the standpoint of the borrowers, 42 countries now have levels of public debt exposure to Chinese lenders exceeding 10 percent of GDP.1

This lending activity has not been without controversy, even on purely economic grounds, setting aside geopolitical considerations. Much of the lending is oriented toward resource extraction, with little apparent regard for recipient institutional quality, with most of the lending going to power and transportation projects.2 The lion’s share of this lending is in US dollars. It is largely non-transparent: for example, what limited public information that exists on the terms of these loans has revealed non-disclosure agreements that hamper multilateral surveillance and restructuring, clauses that can trigger cancellation and require immediate repayment under a wide variety of circumstances, and wide-spread use of collateral requirements and escrow accounts. In the words of one US government official, “all these elements limit a borrower’s ability to engage in standard multilateral restructuring processes and incentivize the borrower to cut side deals on more generous terms with the Chinese creditor.”3

Chinese lending has been criticized for lack of environmental and social safeguards (which is welcomed by some recipients) and the volume of lending could potentially feed moral hazard problems with respect to the IMF and other international financial institutions. That said, some of this lending involves co-financing with establishment institutions, effectively outsourcing due diligence and environmental and social standards. In the case of low-income country borrowers, the G20 established a Common Framework

to address the potential need for coordinated restructuring that may become more acute as global growth remains slow and interest rates rise. To date, Chinese participation in Common Framework restructuring has been uneven. Coordination with the IMF and the Paris Club on debt restructurings for middle-income countries has been similarly problematic.4 While China has not rejected these initiatives, it has yet to fully embrace them either.

Another thrust of the Chinese strategy has been the establishment of the AIIB. China followed the recommendations of the Zedillo Report and established an institution with no resident board, a focus on infrastructure, and streamlined project approval and lending. Reminiscent of the US role at the World Bank, the AIIB is located in China with a Chinese president and Chinese veto power over lending. In this regard, the US (and Japan) got the worst of all worlds: they opposed the creation of the AIIB but failed and are now on the outside looking in, unlike the US experience with the AMF.

A Search for Alternatives

To maintain the dominant reserve currency, the key country in the international financial system should maintain macroeconomic stability at home; an open, transparent rules-based financial system where foreign financial service providers can compete on equal terms with domestic competitors; and offer a range of liquid and safe financial assets to promote cross-border exchange. Critically, the key country must eschew the use of capital controls so that foreign investors have confidence that they can get their money out and not be expropriated. The US has fulfilled this function more or less successfully since the end of the Second World War.

During the late 1980s and into the 1990s, some observers believed that the Japanese yen might be on a trajectory to supplant the US dollar as the key currency of the international financial system. But Japan had a bank-centered financial system, and the lack of capital market depth augured against the country assuming this role. Moreover, it seemed unlikely that the Japanese political system would be willing to open up and surrender its domestically oriented regulatory focus to the degree necessary. In the end, Singapore stole the march on Tokyo and became Asia’s hub for certain kinds of finance.

Now the spotlight has turned to China. It is the dominant trade partner with ASEAN and Central Asia, and it is not hard to imagine that as those trade flows grow, there will be a rising interest in invoicing them in Chinese renminbi. Currency invoicing data is fragmentary, but it appears that by 2015, a quarter of Chinese trade was invoiced in RMB, making it the world’s second most frequently used invoicing currency.5 The complementarity between trade invoicing, bank funding, and use as central bank reserves means that the expanded use of RMB in trade use should induce greater use in these other areas as well. Ancillary policies such as the creation of RMB exchanges and the development of a Chinese alternative to the SWIFT bank messaging system could encourage even greater use, as could the development of the eCNY, a central bank digital currency.6

The surprising success of Western financial sanctions against Russia in response to its invasion of Ukraine, with an eye toward possible action in regard to Taiwan, could also deepen Chinese interest in monetary decoupling. Indeed, the financial sanctions on Russia could encourage other broadly non-aligned countries, including those in Asia, to look for alternatives to Western currencies.

While prospects for the use of the RMB as an invoicing currency look bright, its use as a vehicle for cross-border investment, financial transactions, and as a reserve currency is more uncertain. China has made some progress with the internationalization of the RMB: in 2016, it was added to the IMF’s Special Drawing Right (SDR) basket. (SDRs are an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves by allowing them to borrow foreign exchange held by other IMF members.) And as of the end of 2020, the People’s Bank of China (PBOC) has concluded RMB swap arrangements with a dollar value of $567 billion. In the event, the PBOC could easily substitute US dollars for committed RMB.7

Yet despite China hosting the world’s third largest bond market (after the Eurozone and the US), the RMB’s share of global reserve currencies remains in single digits (figure 1). One issue is that while Chinese entities issue a lot of bonds, they are mainly purchased by buy-and-hold banks. Consequently, the volume of trading in bonds is low relative to their value. More generally, Chinese financial depth, measured by the size of the financial sector scaled by GDP, is still fairly low.

The disjuncture between China’s size and the reserve currency use of the RMB could also be due to a lack of confidence among global investors that in a crisis China would refrain from imposing capital controls.8 This points to the deeper issue of the deleterious impact of the lack of constraints on executive behavior on policy predictability and credibility. In this regard, the extension of Xi Jinping’s paramount leadership to a third term, with the possibility of more, is not salutary. In effect, China now faces the same conundrum that Japan did in the 1980s: while it wants to play a more central role in international finance, it is reluctant to institutionally constrain political discretion over economic policy to the degree necessary to reassure foreign market participants. So, while the centrality of the US dollar is eroding, it still accounts for roughly 60 percent of international reserves.

Setting aside the possibility of a multipolar world for the moment, could Asia adopt a common currency a la the Eurozone? It would seem highly unlikely. Asia does not appear to meet the criteria for an optimal currency area. The region is averse to institutionalization and is characterized by too much diversity and lack of trust to allow the cross-border labor mobility and fiscal integration that would be necessary to make a currency union work.

Will China Seize the Moment?

Is an RMB standard possible? Beyond the governance issues noted above, the answer to that question hinges in part on China’s long-run growth trajectory. China’s economy is slowing; depending on COVID-19 outcomes, it will achieve perhaps 3-5 percent growth in 2022- 23, below target and a three-decade low. Urban youth unemployment has reached 20 percent.

The optimistic view is that the present moment is a temporary aberration, and China can re-attain rapid growth and maintain a relatively high growth rate for another couple of decades.

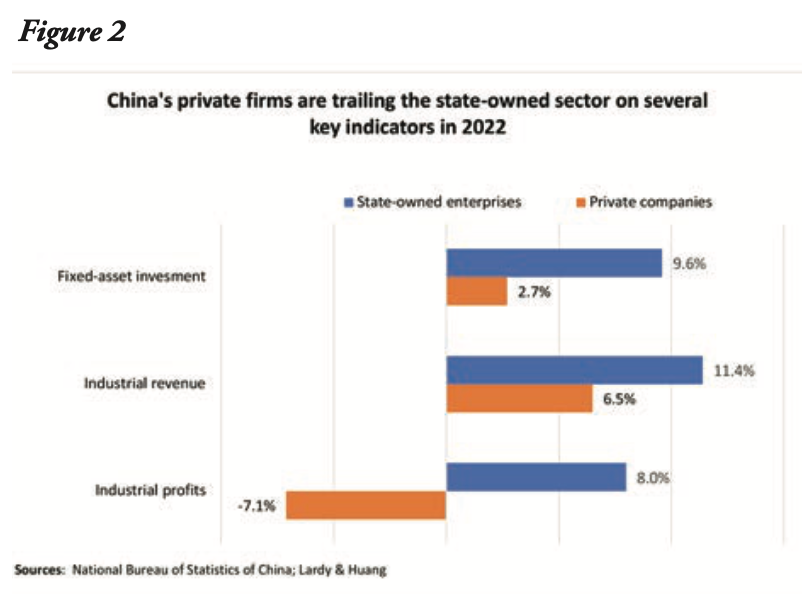

This view is predicated on the observation that there is plenty of room for catch-up (per capita incomes are less than 30 percent of those in the US in purchasing power adjusted terms) and the fundamental reason for the slowdown, a squeeze on the private sector, is reversible. For more than a decade, capital has been channeled into comparatively inefficient state-owned enterprises.9 China’s zero-COVID response to the pandemic deepened this effect (figure 2).10 If China were to rebalance in favor of the private sector, the return on capital would increase and growth would accelerate.

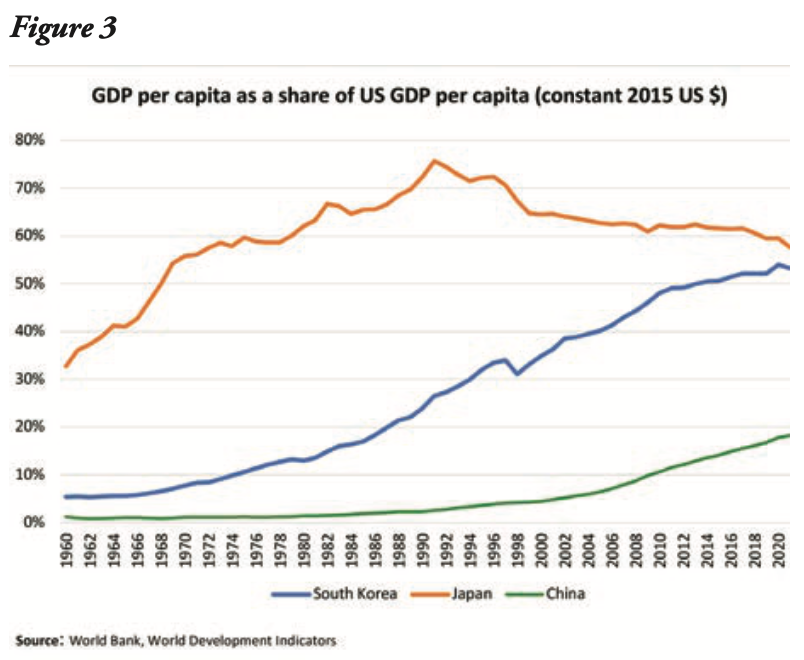

Set against this optimistic view is the abundant evidence that growth slows as countries approach the technological frontier. Per capita incomes in Japan peaked in 1990 at roughly 75 percent of those in the US and declined thereafter (figure 3).

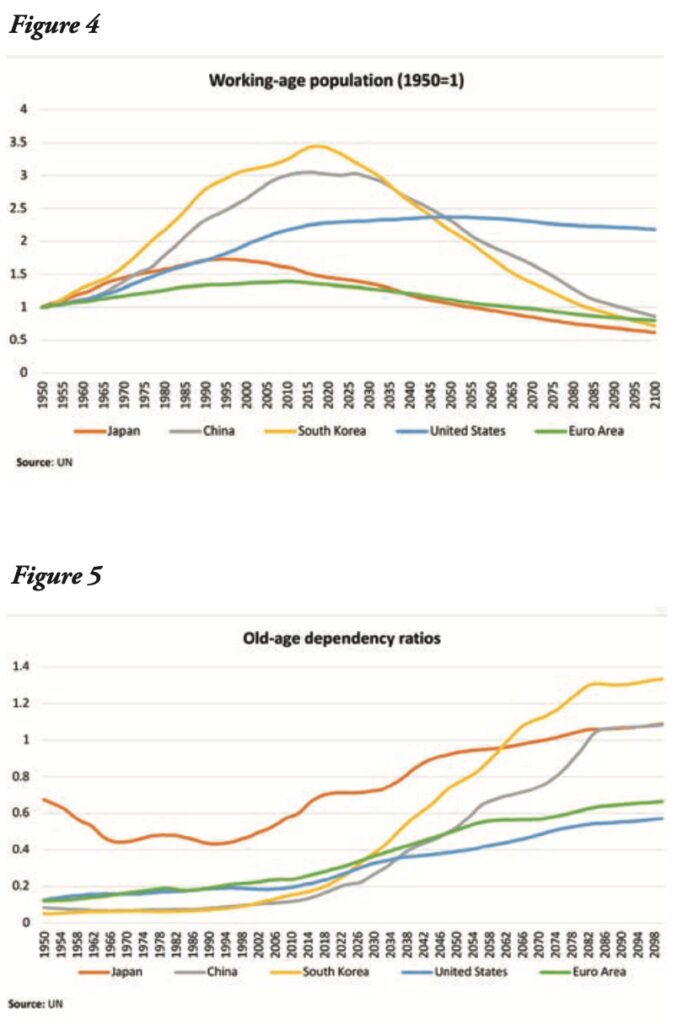

Concerns about the sustainability of Chinese growth are reinforced by the significant demographic headwinds that the country will face for the remainder of the century as its workforce begins to shrink (figure 4) and its dependency ratio rises rapidly (Figure 5). And demographic concerns are not limited to China: Japan’s are well-known, and as illustrated in figures 4 and 5, Korea’s are truly daunting. The US stands out as having the least onerous demo- graphic burden.

Moreover, it is not obvious that a rebalancing of the economy away from the state-owned enterprises or an end to the zero-COVID policy are in the cards. Xi may be politically committed to the state sector and the zero-COVID policy. If so, current performance looks less like an aberration and more like the new normal.

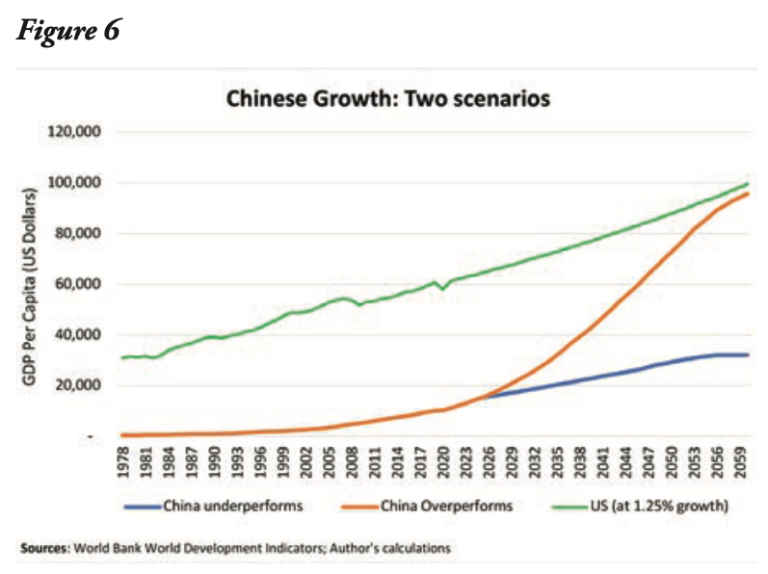

The stakes are enormous: if China were to re-attain recent levels of growth and continue to converge on the US, within decades the Chinese economy would be twice the size of the US, and its centripetal pull would be immense. For purely illustrative purposes, figure 6 plots the relative incomes under two scenarios. In both scenarios, US per capita income grows

at 1.25 percent. In the Chinese high growth scenario, Chinese per capita incomes increase 8 percent annually until 2030, then level off to 6 percent growth by 2040 and 3 percent growth by 2055. In the low growth scenario, per capita income growth falls to 3 percent annually by 2030 and then decelerates until reaching zero in 2055. In the high growth scenario, the per capita incomes of the two countries converge. The disconnect between the relatively diminished US diplomatic and military status on the one hand, and the maintenance of a global dollar standard on the other would be profound. One could easily imagine an expanding “RMB Bloc” and the Chinese currency eventually supplanting the US dollar in the international system. Such changeovers tend to be abrupt, as Ernest Hemingway characterized bankruptcy: “Gradually, then suddenly.”

However, if the weaker growth performance resembling current conditions is projected into the future, China will continue to converge on the US, but like Japan, peak well short of the US income level as the demographic headwinds kick in, its labor force begins to shrink, and the old age burden rises. The dollar might well remain the linchpin of the system, less due to good stewardship than for being the last currency standing.

A final possibility is the emergence of a multipolar world in which two or more currencies coexist with substantial international use.

Such a world existed prior to the First World War, with the British sterling, the French franc and the German mark broadly sharing roles as major international currencies. Eichengreen, Mehl, and Chiţu argue that advances in financial technology will reduce the advantages of incumbency and make it easier for market participants to move between currencies, maintaining diversified portfolios.11

Conclusions

Asian countries have long been unhappy with the international monetary system. Despite having abundant financial resources, they have been unable to offer an effective alternative to the status quo. But in the wake of the Global Financial Crisis, Asia, led by China, has begun playing an intensified strategy of pushing for greater influence in the Bretton Woods insti- tutions while redoubling efforts to construct alternatives. The CMIM has grown and reduced its linkage to the IMF. The failure of the US to embrace proposals to reform the Bretton Woods institutions encouraged China to launch BRI and AIIB, which were welcomed throughout Asia. China’s growing role in trade, investment, and finance is likely to lead to increased use of the RMB in trade invoicing, and one can imagine RMB dominance among Southeast and Central Asia economies that rely heavily on trade with China. The RMB’s use as a reserve currency is also likely to rise albeit from a very low level today.

Asia is too diverse for a currency union along the lines of the Eurozone, but could the RMB eventually supplant the dollar regionally or globally? Among other things this depends on the nature of governance in China and the relative performance of the Chinese economy. There are reasons to believe that China’s current travails are aberrant and that it will resume rapid catch-up with the US. A switchover to an RMB-centered international financial system could occur slowly, then abruptly. But such an outcome is not pre-ordained. It is also possible that, like Japan 30 years ago, China’s relative growth performance could decline, a victim of poor demographics and an inability to reform to maintain productivity growth. In this case, market forces could continue to support the dollar-centered international financial system, not out of its inherent virtues, but for lack of a preferable alternative.

The emergence of a multipolar world where the dollar, RMB, and a revitalized euro were all used prominently in trade invoicing, cross-border investment, and official reserves is in some sense an intermediate outcome. While such an international monetary regime has not been observed for more than 100 years, its development over the next century remains a possibility.