EU Trade Policy Towards China: New Roots Of Conflict? – Analysis

The relationship between the European Union (EU) and China has long been characterized by a complex interdependence marked by both cooperation and competition. Trade has played a central role, with China becoming the EU’s largest trading partner in goods and a significant recipient of foreign direct investment.

However, recent years have witnessed a growing strain in this relationship, owing to the recent shifts in global geopolitics, economic imbalances, and disparities in regulatory frameworks between these two parties. The increased politicization of trade policies has added complexity to the current situation, potentially leading to new conflicts. Such conflicts would harm both parties, hindering their economic development and impeding the achievement of their respective goals. Therefore, maintaining open lines of communication through continued discussions is crucial to addressing and resolving these differences.

EU Trade Policy Towards China

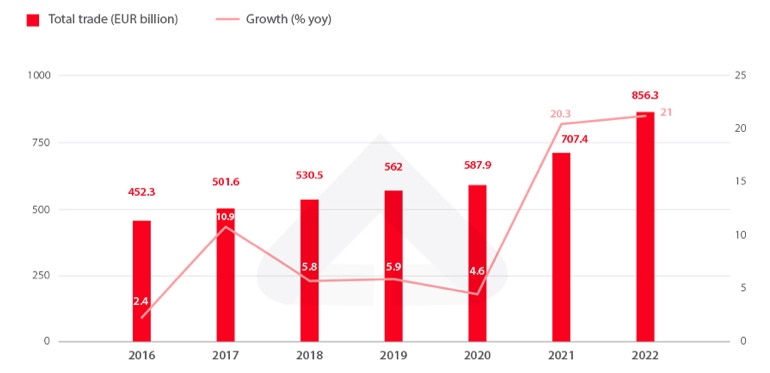

Diplomatic ties between the EU and China were officially established in 1975, but it was only after China acceded to the World Trade Organization (WTO) in 2001 that their trade partnership gained significant momentum. Over the past two years, EU-China trade has experienced substantial growth, surging from a modest 4.6 percent year-on-year increase in 2020 to an impressive 20 percent year-on-year growth in both 2021 and 2022.

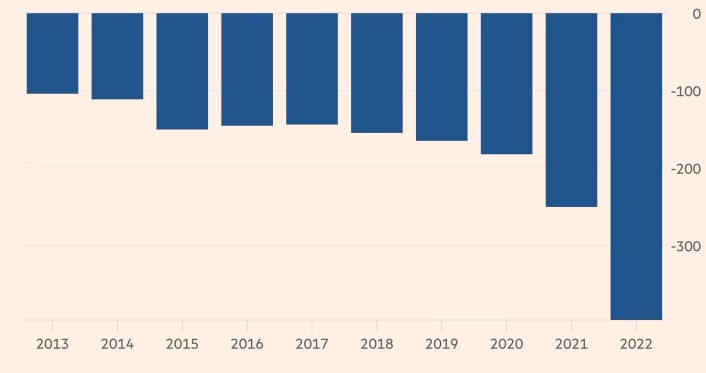

The economies of the EU and China are closely intertwined, engaging in a substantial daily trade of goods amounting to €2.3 billion. However, despite this significant growth, the EU’s trade deficit with China experienced a notable spike, reaching nearly €400 billion in 2022. The EU attributes this trade imbalance primarily to China, citing restricted market access for foreign companies operating in China and substantial subsidies provided by Beijing to its producers in key sectors such as electric vehicles, solar panels, batteries, and wind energy.

In response, the EU has launched several anti-subsidy investigations against China. For example, a recent anti-subsidy investigation targeting Chinese electric vehicles (EVs) was launched by the EU, despite strong objections from China. There is a possibility of a similar investigation being conducted in the medical devices sector and wind turbine, potentially resulting in increased import tariffs or other trade-restrictive measures. The European Commission has also confirmed it would levy provisional anti-dumping duties on some plastic imports from China. During the 10th EU‑China High-Level Economic and Trade Dialogue last year, the EU raised concerns about market barriers affecting European products, issues related to cross-border data flows under the Chinese anti-espionage law, and export controls.

Furthermore, the EU has advocated for more stringent measures and control over the transfer of critical technologies. The bloc accuses China of forcing technology transfers through government-imposed laws, making it a prerequisite for companies to operate in the country. This alleged practice creates an environment of unfair competition and is seen as a direct violation of international trade laws. However, the Chinese government has rejected such claims where it accused the EU of trade protectionism which will create dents in the positive momentum of bilateral trade cooperation.

This hardline policy on trade from the EU towards China cannot be discounted from recent developments in global politics. This was evident in a significant speech by the President of the European Commission, Ursula von der Leyen, made before her visit to China. She emphasized that “security and control now take precedence over the principles of free markets and open trade.” This resolute stance was also reiterated during the EU-China Summit in December 2023, where she raised several politically sensitive issues, including the Russia-Ukraine war, concerns about Chinese companies evading sanctions against Moscow, developments in the Taiwan Strait and the South China Sea, human rights concerns, and sanctions against members of the European Parliament. Simultaneously, EU member states have felt increasing pressure from the US in countering Chinese activities, especially in managing Chinese technological advancements.

The result is visible as the EU has taken a policy of “de-risking” which not only talks about economic de-risking but also diplomatic de-risking. In a statement released in June 2023, the EU expressed its commitment to reducing critical dependencies and vulnerabilities in supply chains, implementing de-risking and diversification measures where needed. Regarding diplomatic de-risking, President Von der Leyen explained that this approach enables the EU to take a firm stance on issues like Russia while keeping trade channels open and fostering dialogues on global concerns.

China has expressed dissatisfaction with such trade remedies from its largest trading partner and voiced concerns over its consequences on the EU-China trade partnership. For instance, Chinese Foreign Minister Wang Yi said in response to the EU’s anti-subsidy investigation that “we urge the EU to avoid protectionist behavior and be prudent in the use of trade remedy measures.” Many Chinese scholars have accused the European bloc of politicization of trade policy which will not bring any good for the EU-China trade relations in the future. Moreover, the adoption of a rigid and irrational stance on trade issues with China is becoming a popular strategy among a faction of hardline politicians in Europe, ostensibly aimed at garnering political support in the forthcoming European Parliament elections in June 2024. If this situation persists, China might respond with more restrictive trade policies in a tit-for-tat fashion. The increasing politicization and the adoption of stringent trade policies by both parties may cultivate the seeds of a new conflict, and the ensuing consequences may prove detrimental for all involved.

Potential Consequences of EU-China Trade Rivalry

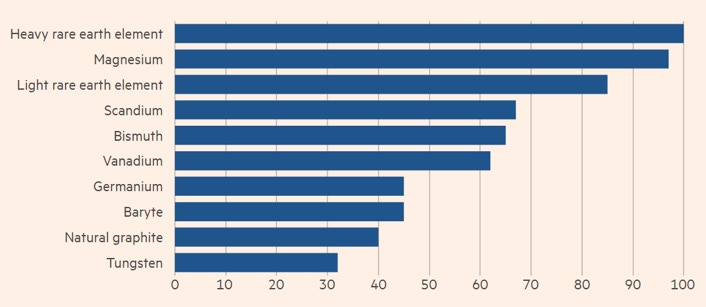

The trade partnership between the EU and China is intricately interwoven, and any disruption could have consequences not only for their economies but also for their political relations. The EU, in particular, has a significant dependence on China for essential raw materials, such as rare earth elements (REEs), vital for clean energy technologies and electronics. Reports indicate that Europe relies on China for 98 percent of specific rare earths crucial in manufacturing technology for wind power generation, hydrogen storage, and batteries. If any conflict disrupts between these two, the accessibility to these resources could be jeopardized, posing a threat to European manufacturing industries and impeding its transition towards clean energy.

Furthermore, following the Russia-Ukraine conflict, decarbonization has emerged as a security concern for the EU. Consequently, the EU is actively working to decrease its reliance on fossil fuels and redirect its attention towards clean energy sources. The EU’s ambitious target of achieving carbon neutrality relies substantially on clean energy technologies, many of which are imported from China. Projections suggest that by 2030, approximately 60% of China’s clean energy technology manufacturing will be geared for export. Any potential trade conflict would jeopardize the EU’s climate-related objectives.

Similarly, a heightened rivalry with the EU could result in China facing elevated tariffs and non-tariff barriers, impeding the smooth flow of trade and deterring EU investments in China. The EU stands as a significant origin of Foreign Direct Investment (FDI) for China, playing a pivotal role in its technological advancement and economic development. Despite a recent decline in investment from EU countries, it remains notably substantial, amounting to $10.03 billion in 2022. As of the close of 2022, the cumulative stock of EU investment in China over the past two decades reached approximately €160 billion to €170 billion.

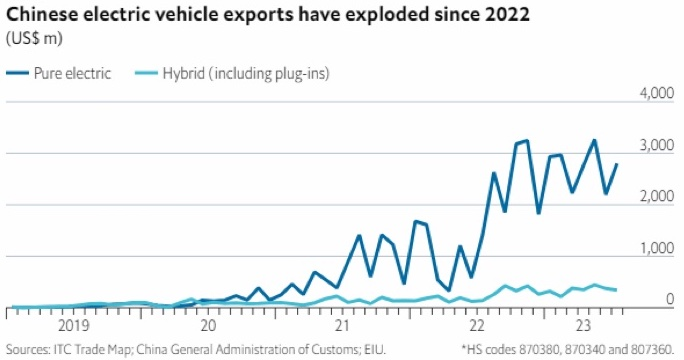

Most importantly, industries like electric vehicles (EVs), which are getting popular in European markets, could suffer significantly from a trade war, impacting Chinese global competitiveness in these strategic sectors.

Beyond economic consequences, a trade war could have deeper political and global ramifications. An escalating trade conflict would likely sour overall EU-China relations, hindering cooperation on critical issues like climate change and global security, and impacting global progress on these challenges. Notably, both the EU and China have made commitments to achieve climate neutrality and carbon neutrality by 2050 and 2060, respectively. The enduring commitment to climate cooperation has been reaffirmed through joint statements on climate in 2010, 2015, and 2021, with the latest leading to the establishment of the High-Level Environment and Climate Dialogue at the cabinet level between the EU and China.

Besides, a trade war could contribute to a wider geopolitical power struggle, potentially leading to the formation of rival economic blocs with distinct rules and standards, further fragmenting the global trade landscape. It would further polarize the global order into two competing blocs which might resonate Cold-war era politics. Such polarization could have far-reaching implications for international relations, potentially undermining global cooperation and stability.

Ways Ahead

Despite the ongoing tension, a trade war between these two economic giants is unlikely. This is evident in the EU’s strategic shift towards ‘de-risking’ rather than ‘decoupling,’ highlighting concerns about the potential economic repercussions of severing ties with the world’s second-largest economy. Additionally, ongoing high-level visits and dialogues have played a crucial role in fostering a friendly atmosphere while addressing differences. Notably, in early November 2022, German Chancellor Olaf Scholz visited China, reciprocated by Chinese Foreign Minister Wang Yi’s tour of Europe in February 2023. Moreover, the 24th EU-China summit took place in Beijing at the end of 2023.

It is important to recognize that the EU consists of 27 countries, each with diverse opinions on collaborating with China. For instance, bilateral trade partnerships sometimes overshadow the broader concerns of the EU as a collective entity. An illustrative example is President Macron’s emphasis on strengthening China-France trade and business ties during his state visit to China last year. Even, the French president brought a group of business leaders with him on the trip, including officials from French multinationals Airbus and Alstrom.

The EU-China trade relationship, once a model of cooperation, faces turbulence fueled by shifting geopolitics, economic imbalances, and regulatory gaps. The EU’s hardening stance, emphasizing security over free markets, risks cultivating conflict, jeopardizing both sides’ access to critical resources, clean technologies, and investment. While complete decoupling seems unlikely, open communication, multilateral cooperation, and addressing systemic issues like market access are crucial to navigating this complex dance. Success requires balancing security concerns with economic interdependence to avoid a trade war that could destabilize global progress and deepen tensions.